Why I Invest My Own Money in These 3 Strategies

They say never trust a chef who doesn’t eat their own cooking. The same rule applies to finance. If I’m writing about it, I’m investing in it.

At Moneyunfiltered, transparency is the currency. I don’t just track markets; I put my capital to work in them.

But let’s be real—the investment landscape in January 2026 is noisy. Bitcoin is swinging around $90,000, US prosecutors are probing the Fed, and everyone is trying to figure out if AI is a bubble or the engine of the next decade.

To cut through the noise, I’ve split my personal wealth into three distinct baskets: Tactical ETFs, SG Top Dividends, and US Growth with Momentum. Here is the unfiltered logic behind why I hold these portfolios right now.

1. The Tactical ETF Portfolio: The “All-Weather” Core

The Goal: Balanced exposure with a strict safety brake.

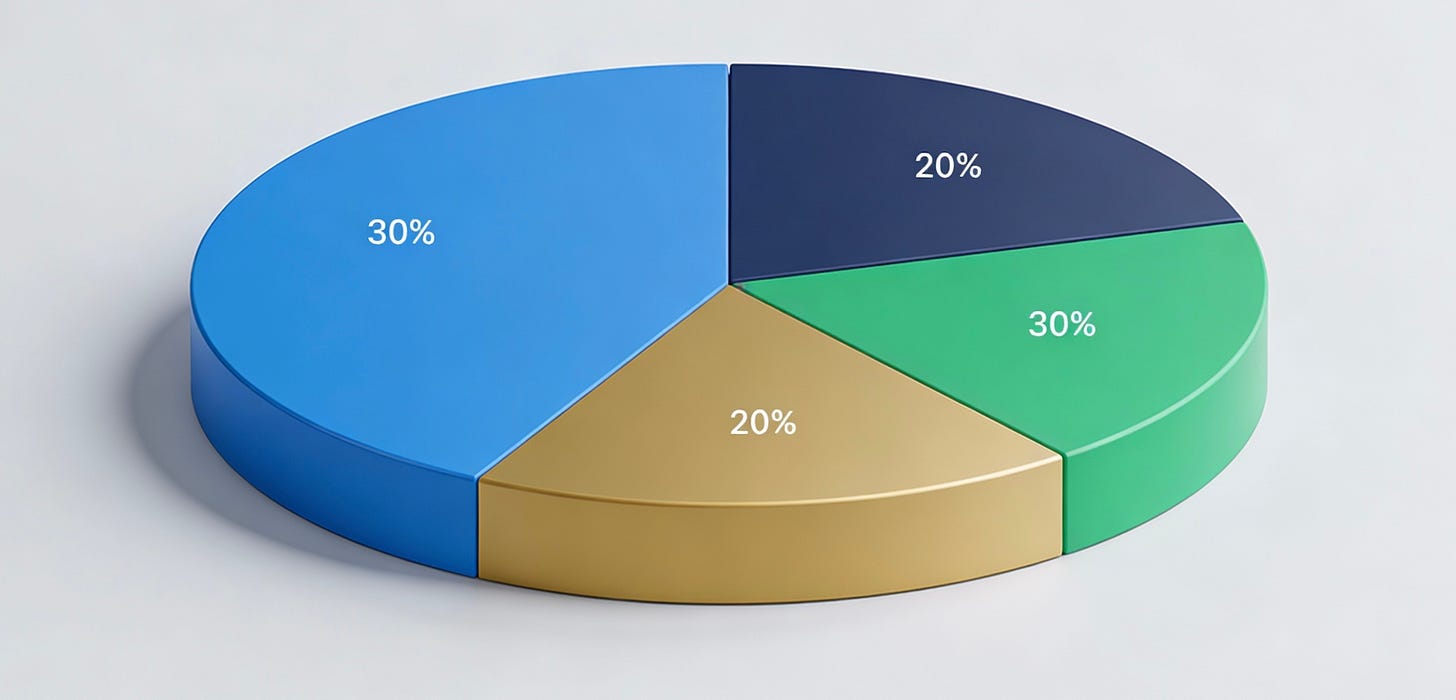

The sheer volume of financial products available today is paralyzing—there are over 14,470 ETFs traded globally. Instead of getting lost in the noise, I stick to a strict 30-30-20-20 allocation designed to capture growth while hedging against disaster.

The Asset Mix:

• 30% QQQM (NASDAQ-100): This is my growth engine. With the AI spending spree hitting the bond market and tech stocks driving records, you simply cannot afford to be zero-weight US tech.

• 30% VWRA (FTSE All-World): My global safety net. This ensures I’m exposed to global rallies, like the recent record highs in South Korea, without betting the farm on a single country.

• 20% SGOL (Gold): The ultimate insurance policy. With Gold hitting records as Fed independence fears rattle markets, this portion protects my purchasing power.

• 20% TLT (20+ Year Treasury Bond): A hedge against economic slowdowns. As rate fears ease and bonds react to election chatter, this adds stability.

The Strategy (Momentum Filter):

I rebalance this portfolio every month. But I don’t just blindly buy. I check a momentum indicator for each ETF.

• Strong Momentum? I stay invested or top up to target weight.

• Weak Momentum? I exit that specific ETF completely and stay in Cash.

This rule prevents me from holding a falling knife. If the trend breaks, I’m out. This helps me reduce the risk by more than 60%!

Check out the latest weightage

2. SG Top Dividends: The “Quality” Income Engine

The Goal: Good yield without the “yield traps.”

Singapore is my anchor. It’s stable and it pays. But in 2026, blindly chasing the highest percentage is dangerous.

The Strategy (The 6-components Framework):

I don’t just pick random stocks. Every month, I run a rigorous screen to pick the Top 10 stocks based on a 6-components framework:

1. Dividends: Is the yield attractive relative to fixed deposits?

2. Performance History: Is the company growing, or is it a melting ice cube?

3. Valuation: Am I overpaying for this income?

4. Business Quality: Is the underlying business model robust?

5. Dividend Quality: Is the payout ratio safe, or are they borrowing to pay me?

6. Financial Health: Is the balance sheet strong?

Why It Matters Now:

We are seeing real opportunities in this space. For example, DBS and OCBC recently jumped and made record high. A simple yield screen might have missed the growth story, but our framework catches the combination of income reliability and business improvement.

3. US Growth with Momentum: Riding the Supercycle

The Goal: Aggressive capital appreciation using systematic rules.

This is where I take the gloves off. This portfolio targets the US market, specifically looking for the next big winners in the “$7 Trillion Data Center Boom” and beyond.

The Strategy (Quant + Momentum):

I remove emotion from the equation entirely.

1. Quantitative Screen: Every month, I screen the US market for high-potential growth stocks using strict quantitative criteria (revenue growth, earnings surprises, etc.).

2. Momentum Ranking: I then rank these survivors based on price momentum.

The Execution:

I buy the top-ranked stocks. If a stock loses its momentum, it gets cut at the next rebalance. This keeps me in names that are working right now—like the companies benefiting from the “AI spending spree”—and gets me out of stagnant positions quickly.

We don’t try to predict if “AI is a bubble”; we simply ride the stocks that the market is rewarding and exit when the music stops.

The Bottom Line

I don’t believe in a one-size-fits-all portfolio.

• Tactical ETFs provide a hedged, global foundation with a cash safety valve.

• SG Dividends generate income through a quality-focused 6-point inspection.

• US Growth chases pure upside using cold, hard data.

Consider giving MoneyUnfiltered a try.

Here’s everything you’ll get:

Here’s everything you get as a paid member

📈 SG Top Dividend List

Updated monthly — a curated list of the most attractively dividend opportunities in the SG market (worth $299)💵 US Growth with Momentum

Rules-based filtering to US tech and growth names, capturing the upside with momentum without the emotional rollercoaster of picking individual winners. (worth $399)

🏅 Tactical ETFs Rebalancing

We took “skin in the game” literally. Every month, we shared our ETF Monthly Rebalancing weightage—that reduced risk by 60% in backtesting. (worth $199)

🔎 ETFs Mastery Series

How I Built a Seven-Figure Portfolio with ETFs

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.