📊 Weekly Market Update: The Great Rotation Begins

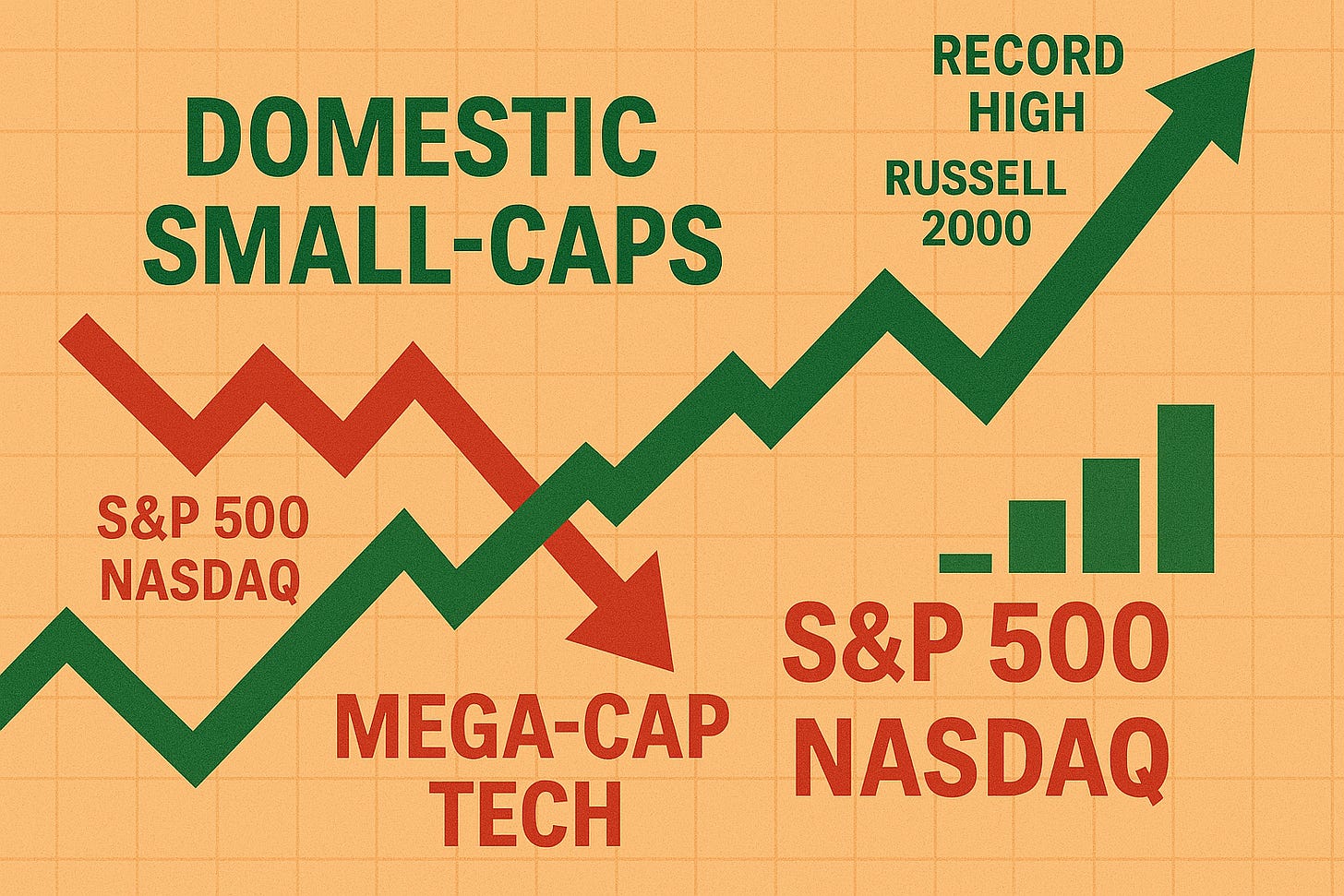

This week, Wall Street witnessed something extraordinary: the biggest rotation out of mega-cap tech and into domestic small-caps we’ve seen since the financial crisis. The Russell 2000 surged 5.8% year-to-date, marking 11 consecutive days of outperformance over the S&P 500—the longest streak since June 6, 2008. While the major indices stumbled (S&P down 0.3%, Nasdaq down 0.6%), smaller stocks hit fresh record highs. This isn’t a blip. It’s a structural regime shift that could reshape your portfolio for the rest of 2026.

🔄 What Is Happening: Three Forces Colliding

The Great Rotation Is Real

For years, the “Magnificent Seven” mega-cap tech stocks and AI darlings dominated returns. But this week exposed a critical problem: valuation extremes. The S&P 500 trades at roughly 26x forward earnings, while the tech-heavy Nasdaq sits even higher. The Russell 2000? Just 18x forward earnings—a 25-year gap that screamed opportunity.

The rotation has institutional fingerprints all over it: $6.4 billion in net inflows flowed into small-cap stocks during 2025, and that momentum accelerated in January. Why? A “soft landing” economic narrative, Fed rate cuts that benefit borrowing-heavy small firms, and 100% bonus depreciation legislation passed last July that gives capital-intensive small businesses immediate tax breaks. Regional banks led the charge, up sharply on a steepening yield curve and renewed M&A appetite from mid-market companies.

The “Battle of the Kevins” Reshapes Interest Rate Expectations

On Friday, President Trump dropped a bombshell: he prefers to keep Kevin Hassett as National Economic Council director—meaning he won’t be Fed Chair. In a stunning shift, Kevin Warsh surged to become the frontrunner in betting markets, now at 43¢ odds vs. Hassett’s 41¢ on PredictIt. This matters because Warsh brings “market credibility” (former Fed Governor, Morgan Stanley pedigree) without Hassett’s reputation as a Trump loyalist willing to slash rates aggressively.

The market immediately repriced expectations: Treasury yields climbed to 4.23% on the 10-year note, signaling traders expect fewer rate cuts in 2026 under a Warsh Fed. This explains why bond traders took a hit and why mega-cap tech (most sensitive to high rates) underperformed.

Wall Street’s Earnings Blowout (Mostly)

Goldman Sachs and Morgan Stanley delivered spectacular Q4 results, posting combined earnings that smashed expectations. Goldman reported $4.6 billion in net income, up 12% year-over-year, with equities trading hitting an all-time record of $4.31 billion. Morgan Stanley wasn’t far behind: $4.4 billion net income (+18% YoY), with full-year wealth management revenues hitting a record $31.8 billion and $356 billion in net new assets.

Investment banking revenues surged 47% at Morgan Stanley and 22% at Goldman, reflecting a boom in dealmaking throughout 2025. However, the overall earnings season is showing mixed signals: while 87.9% of S&P 500 companies beat EPS estimates, the revenue beats percentage is tracking below the historical average. Translation: companies are managing costs effectively, but top-line growth remains modest.

Meta Bets the Ranch on Nuclear Energy

In perhaps the most visionary corporate deal of the week, Meta announced 6.6 GW of nuclear power agreements with Vistra, Oklo, and TerraPower to come online by 2035. This includes immediate purchases from existing plants and funding for advanced reactors still in development. The deal signals unambiguous conviction: AI data centers are consuming massive power, and nuclear is the only realistic solution for reliable, carbon-free baseload energy.

Stocks soared: Vistra and Oklo surged over 15% on the news. Meta just eclipsed Microsoft and Google as the world’s largest corporate nuclear purchaser—a bragging right that also signals serious capital allocation discipline.

Bitcoin Closes In on $100K (But Not Quite)

Bitcoin flirted with $98,000 this week, up a robust 8% in seven days. Polymarket is pricing in a 73% probability of BTC reaching $100K before month-end. The rally reflects easing macro concerns, growing institutional interest, and reduced selling pressure from long-term holders. However, resistance is stiff near the $97K–$100K zone, and order-book depth is down ~30% from 2025 highs, suggesting thin liquidity at key levels.

💭 Why It Matters: The Stakes Are Enormous

Valuations Finally Matter Again

For three years, investors treated valuation like a relic of the past. “This time is different,” they insisted, dumping money into any AI-adjacent mega-cap. This week proved valuation gaps always revert—and the Russell 2000’s explosion is exhibit A. If this rotation continues, your 2026 returns will depend entirely on which sectors you’re overweighted: domestic small-caps and financials win; mega-cap tech loses.

The Fed Chair Matters More Than You Think

Powell’s term ends May 15, 2026. Warsh—the likely successor—will inherit an economy with sticky-enough inflation and unemployment that permadoves like Hassett would have struggled to cut rates as aggressively as Trump desires. Warsh gives Trump “credibility cover”: markets won’t panic at a Trump-influenced Fed because Warsh has deep Wall Street connections. But here’s the catch: you can’t count on 3-4% rate cuts in 2026 the way bond bulls were pricing in two weeks ago. Higher rates = tech and growth valuations under pressure, small-cap and dividend stocks in favor.

AI Infrastructure Is The Real Money Play (Not The AI Hype)

While ChatGPT headlines fade and AI stock euphoria cools, the actual capital is flowing to energy, semiconductors, and infrastructure. Meta’s $6.6B nuclear bet isn’t charity—it’s ruthless capital allocation. Building AI requires power; power requires nuclear; nuclear requires years of permitting and construction. The company capturing that secular trend (infrastructure, not software) will generate the real returns.

Tariff Uncertainty Is Crushing Business Confidence

A stunning 32% of supply chain managers have implemented layoffs—double the 16% figure from April. Two-thirds report cost increases of 10-15% or higher. But here’s the killer: businesses can’t plan long-term because no one knows what Trump’s next tariff move will be. A Supreme Court ruling on tariff legality could bring refunds, but it won’t restore the lost productivity, the administrative overhead, or the abandoned investment projects. This is a silent drag on Q1 2026 GDP growth that few analysts are pricing in.

🚀 The Opportunity: Three Trades to Watch

1. The Small-Cap Trade Is Early (But Crowded)

The Russell 2000’s 5.8% YTD gain is spectacular—but it’s still a 25-year valuation discount vs. large-caps. Jefferies now targets 2,825 on the Russell 2000 by year-end, implying 5-10% more upside from current levels. The risk? This rotation can correct just as fast if inflation resurges or unemployment ticks up. Stick with quality small-caps (strong balance sheets, positive cash flow), not speculative “zombie” companies.

2. Bank Stocks Have Real Earnings Leverage

Goldman and Morgan Stanley posted blockbuster numbers, but they’re not typical banks—they’re investment banking powerhouses that benefit from dealmaking. The real opportunity is regional bank stocks (KeyCorp, Regions Financial, etc.) that are repricing on a steeper yield curve and renewed lending demand. These trade at single-digit multiples on forward earnings, offer 4-5% dividend yields, and benefit directly from small-cap and M&A activity.

3. Bitcoin’s $100K Break Could Spark Retail FOMO

BTC at $97K is tantalizing the retail crowd. If it crosses $100K—a psychological milestone—expect viral headlines and retail inflows. This could provide a 3-6 month tailwind for crypto, crypto-adjacent equities (like MicroStrategy or Coinbase), and digital-asset ETFs. But remember: order-book depth is thin, so moves could be sharp in both directions.

⚡ Bottom Line: Prepare for Two Economies

The market is pricing in a “soft landing” scenario where rate cuts continue, inflation stays benign, and small-cap earnings accelerate. But the tariff situation is a silent time-bomb. If Trump escalates trade wars or the tariff courts rule against the administration, expect a sharp rerating of growth expectations and a potential return to mega-cap dominance.

For the next 4-6 weeks, the real action is:

Rotation trade: Overweight small-caps, underweight mega-cap tech

Rate bets: Warsh’s nomination likely means less aggressive cuts; favor dividend and value sectors

Earnings surprises: Watch Netflix (Jan 20) and Capital One (Jan 22) for guidance on 2026 momentum

Tariff clarity: The Supreme Court ruling could be a multi-hundred-basis-point event for risk assets

The era of “AI at any price” is officially over. Welcome to the era of valuation, cash flow, and domestic small-cap resurgence. Position accordingly.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.