📊 Weekly Market Update: The Geopolitical Hangover

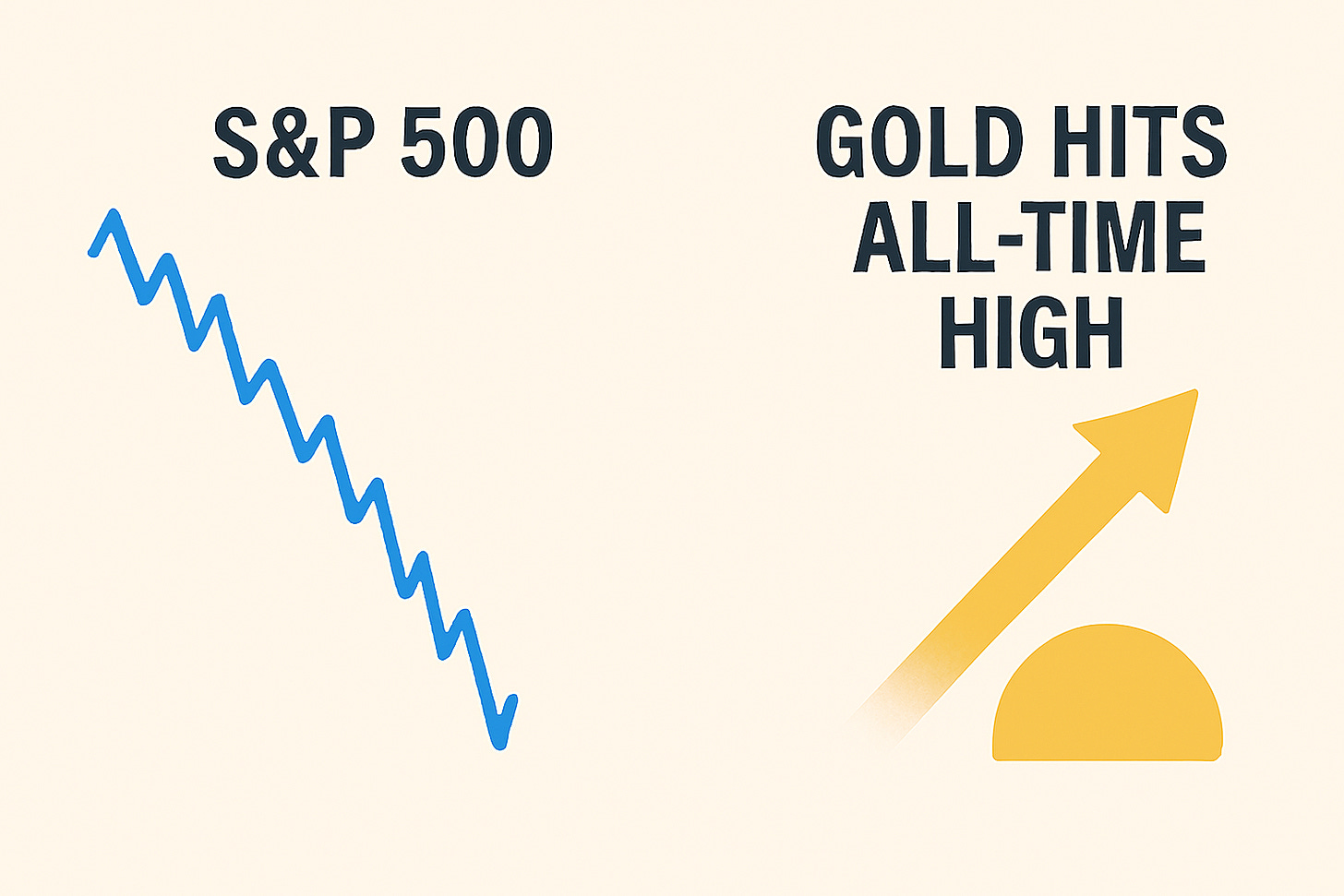

This week was everything investors shouldn’t want: whiplash governance changes, a semiconductor giant’s stunning underperformance despite industry tailwinds, and safe-haven assets hitting all-time highs. The S&P 500 posted its second consecutive losing week as geopolitical uncertainty and disappointing corporate guidance collided head-on. But by week’s end, markets caught a glimpse of reprieve as President Trump backtracked on European tariffs—at least for now.

📊 What Is Happening

The Greenland Drama Ends (Or Does It?) — President Trump spent the week weaponizing Greenland as leverage for tariff negotiations. On January 20, markets tanked as he threatened 10% tariffs on eight European nations (Denmark, Sweden, France, the UK, the Netherlands, and Finland), escalating to 25% by June unless the U.S. could acquire Greenland. Then, on January 21 at Davos, Trump met with NATO Secretary General Mark Rutte and announced a “framework deal,” scrapping the tariff threats entirely. Stocks immediately jumped. The Dow climbed nearly 600 points, and all three major indices logged back-to-back days of gains as relief washed over Wall Street.

Intel’s Stunning Disappointment — While the market rallied on geopolitical news, Intel crushed investor hopes on January 23. The chip giant beat Q4 earnings estimates (reporting $0.15 EPS vs. $0.08 expected) but demolished forward guidance. Intel projected Q1 2026 revenue of $11.7–12.7 billion (consensus: $12.51B) and breakeven adjusted earnings versus analyst expectations of $0.05 EPS. The culprit? Data center revenue is expected to decline sequentially—a shocking miss given the AI boom. The problem stems from supply constraints, yield issues, and advanced packaging bottlenecks at Intel’s cutting-edge 18A fabs. Shares plummeted 12–16% in a single day, erasing nearly $31 billion in market cap—Intel’s worst day since early 2024.

Gold Hits All-Time High — While stocks churned, precious metals soared. Gold climbed to an all-time high of $4,987.30 per ounce this week, capping its best week since 2020. Silver crossed $100/oz for the first time. The rally reflects classic safe-haven demand: geopolitical uncertainty (Greenland threats, tariff chaos), weak U.S. dollar dynamics, and investor anxiety over corporate execution. Gold is up 11.35% this month alone and 79.24% year-over-year.

Broader Market Damage — The S&P 500, Nasdaq, and Dow all posted consecutive weekly losses. Markets whipsawed between relief (geopolitics) and anxiety (earnings disappointments, small-cap weakness). Alaska Air Group bucked the trend, beating earnings and posting a 5% gain Friday on strong premium seating demand. However, small-caps (Russell 2000) lost momentum, tracking for their worst week in six weeks.

💡 Why It Matters

Volatility = Opportunity Cost — This week’s wild swings underscore a harder truth for investors: political risk is now priced as a material asset class. Tariff announcements don’t just affect trade; they hit equity risk premiums overnight. For a week, European exposure became toxic; then it wasn’t. This tail-wagging-the-dog dynamic increases volatility and rewards market-timers while punishing disciplined long-term investors.

Intel’s Failure Exposes an AI Narrative Problem — Here’s the uncomfortable reality: Intel has all the right pieces but can’t execute. Despite being “sold out” of server CPUs and commanding record demand for AI chips, Intel is losing share to AMD due to manufacturing bottlenecks. For a company betting its entire future on foundry services (selling chips to others), this Q1 guidance collapse signals that Intel isn’t yet a credible long-term supplier. If Intel can’t capture even its own demand, why would a major customer like Apple or Qualcomm risk external foundry work with them? The stock reaction wasn’t overblown—it was the market reassessing Intel’s execution risk in real time.

Safe-Haven Rally Questions Fed Assumptions — Gold’s record high isn’t just sentiment; it’s a real vote of no-confidence in growth and stability assumptions. Central banks are still buying, but the broader message is that investors are increasingly defensive. If the Fed stays “higher for longer” with rates while tariff uncertainty persists, gold’s argument—as a hedge against fiscal deficits and currency weakness—only gets stronger.

Earnings Season in Full Swing — Major banks reported this week (JPMorgan, BofA, Citigroup, Morgan Stanley, Goldman Sachs), and consensus expectations remain resilient. However, Intel’s miss signals that guidance matters more than beats. Wall Street loves upside surprises, but it punishes forward-looking disappointments mercilessly.

🚀 Opportunity

1. Semiconductor Dislocation — Intel’s collapse offers a contrarian play. If yield issues ease in Q2 2026, Intel could be a 30–40% rebound candidate. The market is now in “show me” mode, which means any positive surprise on 18A yield or foundry customer announcements could trigger short-covering and fundamental buying. For dividend-focused investors, this isn’t ideal, but for growth-oriented traders: watch for Intel analyst day in H2 2026.

2. Sector Rotation into Defensive Plays — Gold’s rally signals that defensive sectors (utilities, healthcare, REITs, dividend stocks) may outperform in a volatile 2026. For your portfolio, consider rotating underweight growth tech into higher-yielding dividend stocks—especially Singapore dividend names or U.S. utility ETFs if tariff anxiety persists.

3. European Sector Opportunity — European stocks got hammered by tariff threats, then recovered on Trump’s reversal. This creates a potential value trap or a genuine bargain, depending on how seriously you take the tariff threat. HSBC, luxury goods exporters, and EU manufacturers could see outflows if tariffs re-escalate. For contrarians: oversold European banks might offer entry points if tariff tensions cool.

4. Gold ETFs for Hedging — If your portfolio is overweight growth/tech (QQQ, SPY), adding 5–10% to gold or gold mining ETFs (GLD, IAU) as a hedge makes sense. This week proved that gold isn’t correlated to equities when geopolitical risk spikes. At record highs, it’s not “cheap,” but it’s increasingly justified by macro uncertainty.

5. Earnings Quality Over Beats — As this week showed, hitting earnings estimates is the entry fee; forward guidance is the payoff. When analyzing stocks this quarter, focus on management commentary about Q2 and FY2026 guidance. Companies that raise guidance attract rotating capital; those that miss guidance get punished regardless of beat size (hello, Intel).

🎯 Bottom Line

**2026 is shaping up as the year of ** political theater and execution risk. **

Trump’s tariff threats will likely remain a persistent overhang—this Greenland episode won’t be the last shock. Meanwhile, companies face a harsh new reality: the AI boom is real, but supply chains are stressed. Intel’s collapse is a cautionary tale: even category-defining companies can stumble if they can’t deliver product.

For investors:

Stay diversified. Geopolitical volatility is here to stay.

Own some optionality—gold, defensive dividend stocks, and 10% dry powder for dips.

Focus on execution, not headlines. Earnings guidance matters more than beats.

Rotate into compounders with moats. If tariffs do escalate, domestic, low-leverage business models will outperform.

The market’s back-to-back losing weeks reflect genuine confusion. But by Friday’s close, it was clear: investors aren’t panicking yet—they’re repositioning. That’s healthy. Watch for the Fed’s next move and earnings revisions this quarter. That’s where the real directional signals lie.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.