📊 Weak Jobs Report Sparks Market Turbulence

We're excited to launch our new "Retiring with ETFs" mastery series, available free to all members! This comprehensive 8-week program delivers weekly episodes to help you master ETF investing for retirement. Don't miss out—once the series concludes, this valuable content will become exclusive to paid subscribers.

Subscribe to our newsletter today to secure your free access!

Wall Street stumbled on Friday as August's disappointing jobs report sent shockwaves through financial markets, pushing unemployment to its highest level since 2021 and amplifying concerns about the U.S. economic outlook. The dismal hiring figures have dramatically shifted Federal Reserve expectations and triggered a risk-off sentiment across asset classes.

📈 What's Happening

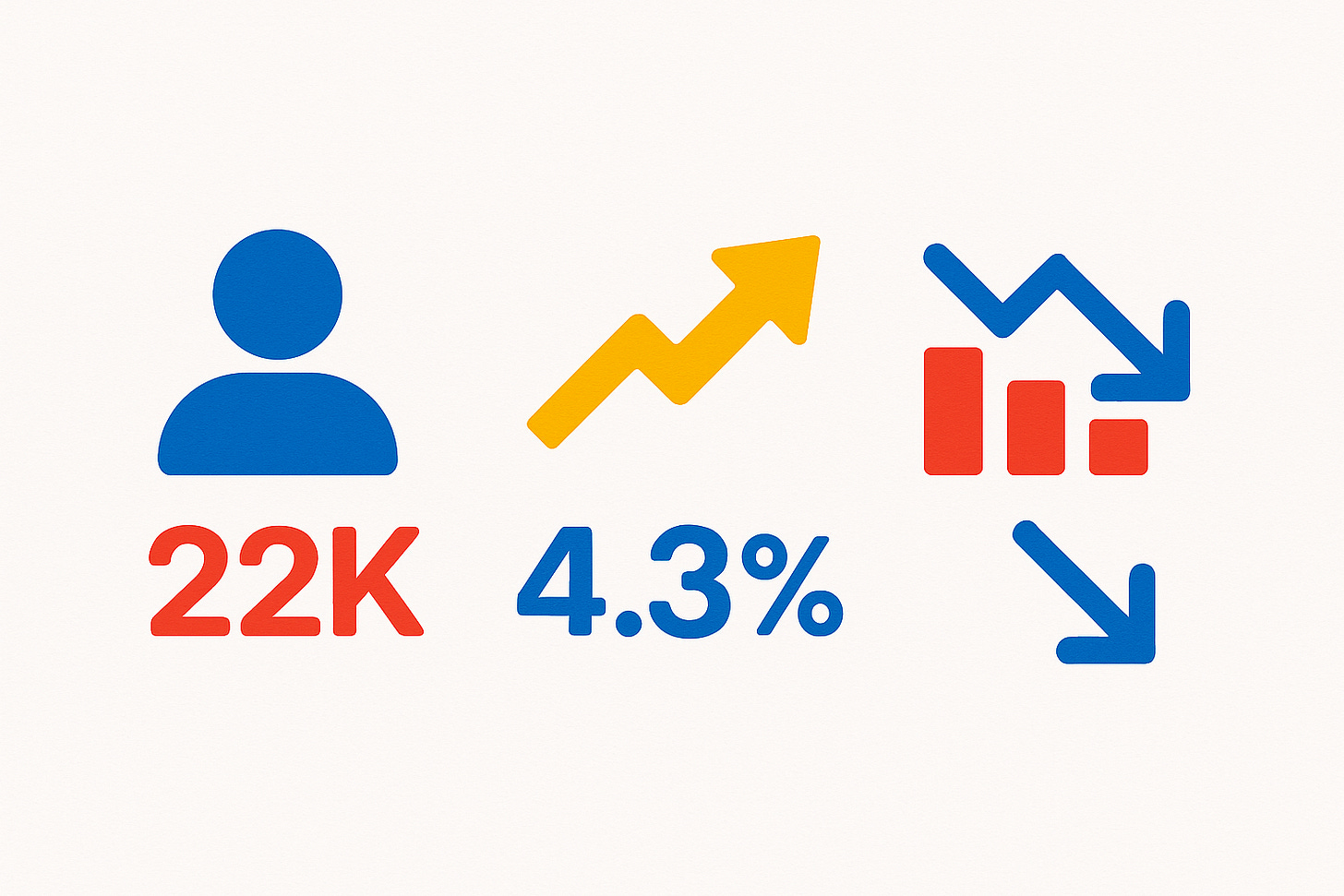

The Bureau of Labor Statistics delivered a concerning blow to market confidence with August's employment data. The economy added just 22,000 jobs, falling dramatically short of economists' expectations for 75,000 new positions. Even more troubling, the unemployment rate climbed to 4.3%, marking the highest level since October 2021.

The report revealed deeper structural weaknesses. June's employment figures were revised down to show the first job losses since 2020, with 13,000 positions eliminated. Manufacturing shed 12,000 jobs while professional and business services lost 17,000 positions. Federal government payrolls declined by 15,000, contributing to a 97,000 reduction in federal employment since January due to significant spending cuts.

Stock markets responded with immediate selling pressure. The S&P 500 fell 0.3% from Thursday's record high, while the Nasdaq remained flat and the Dow dropped 0.5%. Treasury yields plummeted as investors fled to safety, with the 10-year yield falling to 4.07% - its lowest level since April.

August jobs report shows weak hiring with unemployment rising to 4.3%

💡 Why It Matters

This employment data represents more than just a single disappointing month - it signals a fundamental shift in the U.S. labor market dynamics. The Trump administration's economic policies, particularly aggressive tariffs and immigration restrictions, are creating significant headwinds for business hiring decisions.

The broader implications extend to Federal Reserve policy. Market participants now see a 100% probability of an interest rate cut at September's FOMC meeting, with growing speculation about a potential 50 basis point reduction rather than the typical 25 basis point move. This marks a dramatic shift from just weeks ago when rate cut expectations were far more modest.

The timing couldn't be more critical. September historically represents the worst-performing month for stocks, with the S&P 500 averaging negative returns during this period. Combined with elevated market valuations and concentration risks in technology stocks, the weak employment data introduces additional volatility catalysts.

🎯 Opportunity

The diverging economic signals present compelling investment opportunities. Interest rate-sensitive sectors like utilities and real estate investment trusts (REITs) stand to benefit from the anticipated Fed dovishness. Homebuilding stocks have already begun rallying on expectations that mortgage rates will decline.

Conversely, the labor market weakness suggests potential value opportunities in beaten-down small-cap stocks, which typically outperform when economic conditions stabilize. The Russell 2000's recent underperformance relative to large-cap indices creates attractive entry points for patient investors.

Bond investors should consider duration positioning as yields appear poised for further declines if economic data continues deteriorating. The 10-year Treasury's drop below 4.1% suggests potential for additional gains in longer-duration securities.

🔻 Bottom Line

Friday's jobs report crystallizes the economic crosscurrents facing markets as 2025's final quarter approaches. While the immediate reaction suggests investor anxiety, the Federal Reserve's likely policy response could provide the monetary accommodation needed to sustain the economic expansion. The key question remains whether recent weakness represents temporary policy-induced headwinds or the beginning of a more significant economic slowdown. Smart investors will monitor September's inflation data closely - it could determine whether the Fed delivers the aggressive easing markets increasingly expect or maintains a more measured approach to rate cuts.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.