Singapore Savings Bonds (SSB) Aug 2024 Guide

In case you missed it:

As a resident of Singapore, you may have heard of the Singapore Savings Bonds (SSB). It’s one of the more common and low risk options for Singaporeans to invest their money to fight inflation in Singapore. But what exactly are Singapore Savings Bonds and why should you invest in them?

First, let’s talk about inflation. For reference, the Monetary Authority of Singapore (MAS) Core Inflation in June 2024 fell to 2.4% compared to 3.1% in May. Having said that, this means that the prices of goods and services are still increasing, and the value of your money is decreasing over time. Investing in Singapore Savings Bonds can help protect your money from depreciating due to inflation.

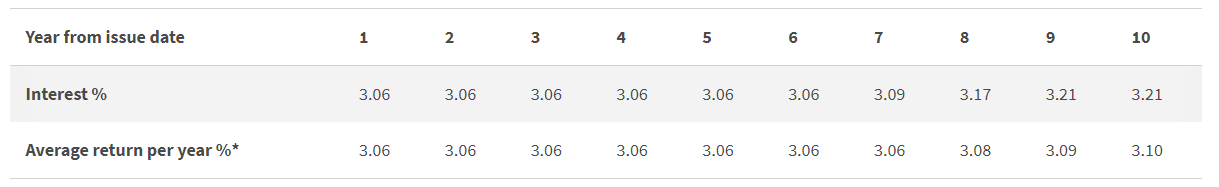

The interest rate for SSB changes every month with each issue, and this month the interest rate continue to be stable at 3.1%. If you invest $1,000 in this issue of Singapore Savings Bonds and hold it for the full 10 years, you’ll get $310 in interest. That’s not a bad return for a risk-free investment.

What are Singapore Savings Bonds?

Singapore Savings Bonds are a type of government bond issued by the Monetary Authority of Singapore (MAS). They’re designed to provide Singaporeans with a safe and flexible option for long-term savings. These bonds are different from traditional government bonds because they offer a flexible tenor and interest rates that adjust to current market conditions.

How do Singapore Savings Bonds work?

The interest rate for Singapore Savings Bonds changes every month with each issue. The bonds have a tenor of 10 years, but you can redeem them at any time without penalty. The longer you hold on to the bond, the higher the interest rate you’ll enjoy. This makes SSBs a great option for long-term savings.

Another advantage of Singapore Savings Bonds is that they’re backed by the Singapore Government. This means that the amount you invest is completely safe and secure. The Singapore Government has received a “AAA” credit rating, which reduces the risks of investing in SSBs to the bare minimum. This makes SSBs one of the safest products in the market.

How much should you invest in Singapore Savings Bonds?

The minimum amount to invest in SSBs is $500, which makes it suitable for almost everybody. However, the maximum amount you can invest in SSB is currently set at $200,000. This includes bonds bought with cash and your SRS monies. So even if you’re a millionaire, you can’t dump all your money into SSBs.

Can you use your CPF to buy Singapore Savings Bonds?

No, you cannot use your Central Provident Fund (CPF) to buy SSBs. However, you can use your SRS monies to buy SSBs.

Are Singapore Savings Bonds taxable?

No, Singapore Savings Bonds are exempt from tax in Singapore. This means that you won’t have to pay any tax on the interest you earn from your SSBs.

How to buy Singapore Savings Bonds?

To buy Singapore Savings Bonds, you need a bank account with any local banks in Singapore (DBS/POSB, OCBC, or UOB) and a Central Depository (CDP) account that is linked to the bank account you intend to invest with. You can apply for a Singapore Savings Bond through two methods:

Apply at an ATM (only DBS/POSB, OCBC, or UOB) or

Apply through Internet Banking under Singapore Government Securities.

Each application is capped at $50,000. Once you’ve applied for your SSB, all you have to do is sit back and relax. The results will be announced after the “last day to apply date”.

Is Singapore Savings Bond a good investment?

Before you invest in Singapore Savings Bonds, it’s important to take a closer look at the risks and benefits. Here are some of the pros and cons of investing in SSBs.

PROS:

Safe and secure: Singapore Savings Bonds are backed by the Singapore Government, making them one of the safest products in the market.

Flexible: You can redeem your SSBs at any time without penalty.

Tax-exempt: SSBs are exempt from tax in Singapore.

CONS:

Low returns: The interest rates for SSBs are relatively low compared to other investment options.

Long-term commitment: SSBs have a tenor of 10 years, so you need to be willing to commit to holding on to your investment for a long

There’s also the risk of opportunity cost. While SSBs are a safe investment, they may not provide the same returns as other riskier investments. For example, if you invest in stocks, you may potentially earn higher returns than investing in SSBs. However, investing in stocks comes with a higher risk.

Summary

Overall, the Singapore Savings Bond is a good option for investors who are looking for a low-risk, flexible investment option with attractive interest rates. However, investors should also consider their investment goals, risk tolerance, and other investment options before making a decision.

In conclusion, the Singapore Savings Bond is a good investment option for Singaporeans who are looking for a low-risk, flexible investment option with attractive interest rates. However, investors should also consider their investment goals and risk tolerance before investing in the bond.

Sign up now and get our free dividend stock list for free.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.