Singapore Banks Deep Dive: DBS vs UOB vs OCBC

We are soft-launching our SG Top Dividend List

Here’s everything you get as a paid member

📈 List of SG Top Dividend List

Updated monthly — a curated list of the most attractively dividend opportunities in the SG market (worth $299)🧠 In-Depth Research

Deep dives into dividend and growth stocks (worth $199)

For the first 50 signups (32 spots left), you will enjoy a discounted price of $63.60 per annum, which is less than $0.19 per day!

All three of Singapore’s leading banks published their third-quarter 2025 earnings this week, revealing divergent paths as they navigate falling interest rates and shifting revenue models. DBS emerged as the clear leader with record profits driven by wealth management momentum, OCBC delivered stable results with the sector’s best asset quality, while UOB’s headline numbers were dramatically impacted by proactive provisioning despite underlying operational strength.

Overall Winner: DBS Dominates with a Score of 97/100

Based on comprehensive scoring across six dimensions, DBS leads with 97/100 total points, followed by OCBC at 93/100 and UOB at 88/100.

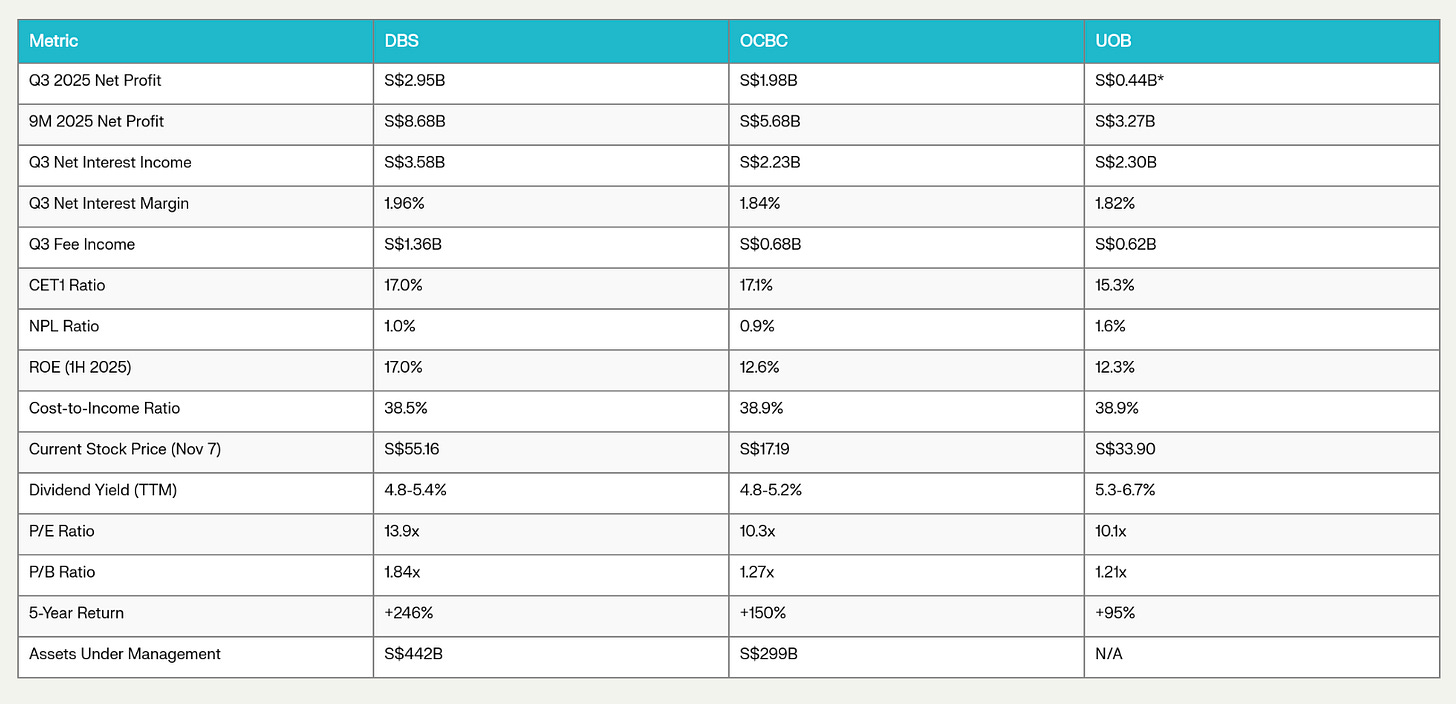

Key Metrics

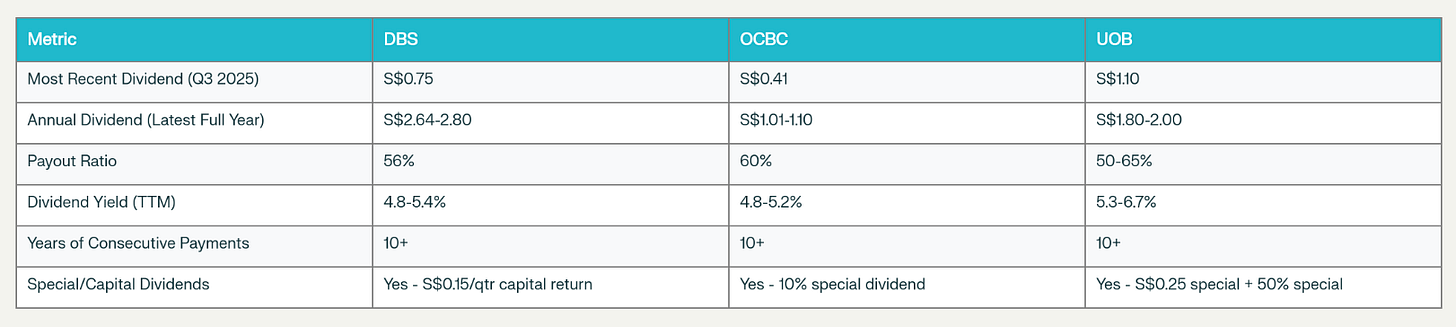

💰 Dividend Track Record (25% Weight)

DBS: 25/25 Points - Exceptional Growth and Capital Returns

DBS demonstrates the strongest dividend momentum among the trio. For Q3 2025, the bank declared a total dividend of S$0.75 per share - comprising a S$0.60 interim dividend plus a S$0.15 capital return dividend, representing a 39% increase from the S$0.54 paid in Q3 2024. This marks DBS’s commitment to aggressive shareholder returns, with dividends growing at an average annual rate of 27-32% over recent years.

The bank’s payout ratio stands at approximately 56%, providing substantial room for sustainability while returning significant cash to shareholders. DBS has maintained uninterrupted dividend payments for over 10 years with consistent growth, never cutting dividends during the past five years. The addition of the quarterly capital return dividend of S$0.15 per share throughout 2025 demonstrates confidence in excess capital generation capabilities.

OCBC: 24/25 Points - Enhanced Returns Through Dual Dividend Strategy

OCBC raised its total dividend payout ratio to 60% for both 2024 and 2025, comprising a 50% ordinary payout ratio plus an additional 10% special dividend. This S$2.5 billion capital return program includes special dividends and share buybacks over two years, to be completed in 2026.

For Q3 2025, the bank’s dividend stood at S$0.41 per share, maintaining consistent payments. OCBC’s dividend per share has grown from S$0.32 in 2020 to S$1.01 in 2024, reflecting 23% year-over-year growth. The bank has maintained a 10+ year track record of consistent dividends with minimal cuts, demonstrating strong reliability.

UOB: 23/25 Points - Solid Track Record with Special Dividend Commitment

UOB maintains a 50% ordinary dividend payout ratio, supplemented by special dividends. The bank declared an interim dividend of S$0.85 per share in Q3 2025, representing a 50% payout ratio, alongside a second tranche of S$0.25 special dividend as part of its S$2.2 billion capital distribution package.

UOB’s annual dividends have grown from S$0.78 in 2020 to S$1.80 in 2024 (including special dividends), demonstrating consistent growth. The bank’s dividend yield over the trailing twelve months ranges from 5.3% to 6.7%, the highest among the three banks. Despite the Q3 provision impact, management confirmed the 2025 final dividend would not be affected, signaling commitment to shareholder returns even during proactive balance sheet strengthening.

Ranking: DBS (25) > OCBC (24) > UOB (23)