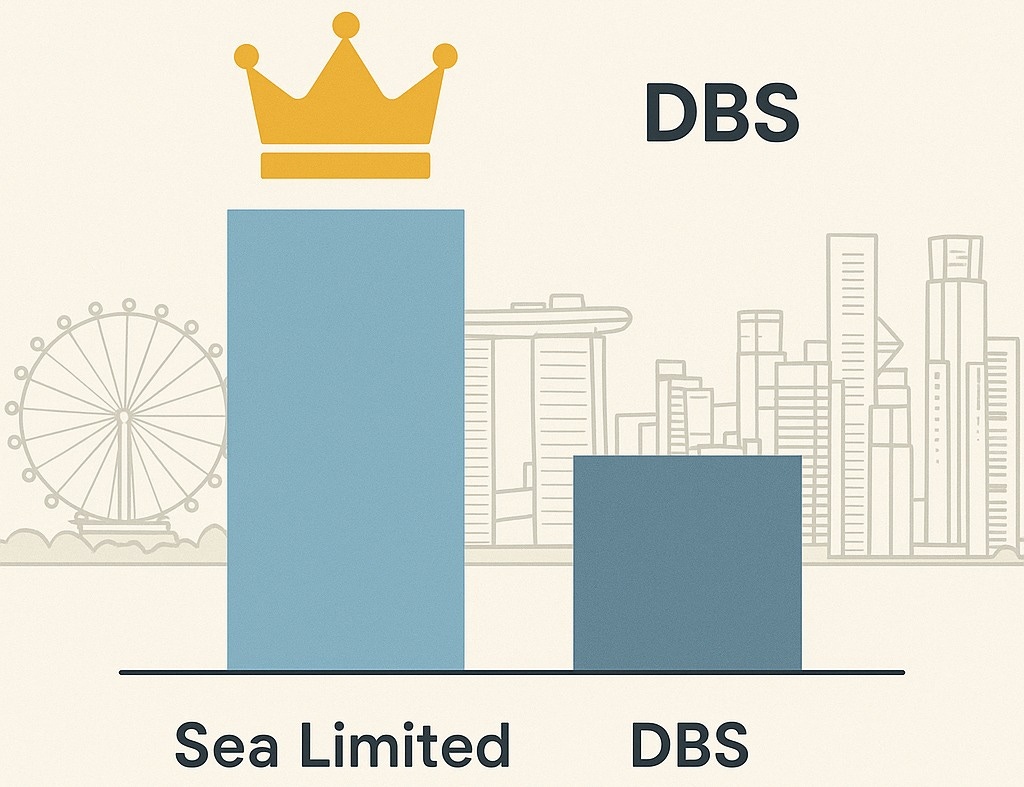

👑 Sea Limited Dethrones DBS as Southeast Asia’s Crown Jewel

We're excited to launch our new "Retiring with ETFs" mastery series, available free to all members! This comprehensive 8-week program delivers weekly episodes to help you master ETF investing for retirement. Don't miss out—once the series concludes, this valuable content will become exclusive to paid subscribers.

Subscribe to our newsletter today to secure your free access!

The e-commerce giant’s spectacular 300% comeback rally has officially made it the region’s most valuable public company with a $111 billion market cap.

🔥 What’s Happening

On Monday, August 26, 2025, Sea Limited achieved a historic milestone by reclaiming its position as Southeast Asia’s most valuable publicly traded company. The Singapore-based tech giant’s shares rose 1.1% in New York trading, pushing its market capitalization to $111 billion. Meanwhile, regional banking powerhouse DBS Group Holdings slipped 0.6% in Singapore, ending with a valuation of $110.3 billion - officially ceding the crown to Sea.

This remarkable turnaround represents a 300% comeback rally since the start of 2024, primarily driven by the explosive growth of Sea’s e-commerce arm, Shopee. The company has demonstrated its resilience against fierce competition from ByteDance’s TikTok Shop, Alibaba’s Lazada, and newcomer Temu in the region’s $160 billion e-commerce market.

⚡ Why It Matters

This market cap switch isn’t just about bragging rights - it signals a fundamental shift in Southeast Asia’s economic landscape. Sea’s dominance showcases how digital transformation is reshaping traditional business hierarchies in the region.

Shopee has cemented its leadership in Southeast Asia’s e-commerce space, capturing an impressive 56% market share of gross merchandise value among leading platforms, while TikTok Shop holds 19% and Lazada 15%. The platform’s success stems from years of strategic investment in digital offerings and delivery operations, coupled with a brutal cost-cutting drive that brought CEO Forrest Li’s company to profitability.

The secret weapon behind this success is SPX Express, Sea’s little-known logistics operation that now handles the majority of Shopee’s billions of parcels annually. This hyper-local delivery network - powered by an army of homemakers, students, and retirees - has achieved 90% next-day delivery in Singapore and captured approximately 25% of the regional logistics market share.

💰 The Opportunity

Sea’s triumph offers multiple investment angles worth considering:

Growth Trajectory: The company reported record-breaking sales in August that topped analyst estimates, with Q2 2025 revenue surging 38% to $5.26 billion. Net income jumped dramatically to $414.2 million from $79.9 million the previous year.

Diversification Play: Beyond e-commerce, Sea is betting big on digital financial services through its Monee division, which saw sales rise 70% in Q2 2025 with a loan book of $6.9 billion and a low 1.3% delinquency rate.

Regional Expansion: SPX Express is expanding globally, having already reduced logistics costs by 21% in Brazil and formed partnerships with major retailers like Shopify and Uniqlo.

For investors, this represents exposure to Southeast Asia’s accelerating digital economy, projected to hit $230 billion by 2027. Sea offers a rare combination of a defensible business model, scalable infrastructure, and proven adaptability to regional challenges.

🎯 Bottom Line

Sea Limited’s coronation as Southeast Asia’s most valuable company marks more than just a market cap milestone - it’s validation of the digital-first future in emerging markets. While DBS remains a banking powerhouse with its 65% stock surge since early 2024, Sea’s logistics-powered e-commerce dominance has captured investors’ imagination about the region’s growth potential.

The company has successfully transformed from a pandemic-era boom-and-bust story into a sustainable growth engine with expanding profit margins and diversified revenue streams. With Shopee’s market leadership secured and SPX Express creating a defensive moat against competitors, Sea is positioning itself not just as a regional champion, but as a global logistics and e-commerce player.

For investors seeking emerging market exposure, Sea’s story demonstrates how strategic infrastructure investments can reshape entire industries - and create enormous shareholder value in the process.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.