Portfolio Performance - Nov 2024

In case you missed it:

As the holiday season kicks off, Black Friday brought more than just shopping deals; it marked a triumphant close to an extraordinary November for the stock market. Two of the three major blue-chip indexes hit new closing highs, and the excitement in the air was palpable. Let’s dive into the details of this remarkable month and what it means for the road ahead.

The Dow Jones Industrial Average celebrated a significant milestone, climbing 192 points (or 0.4%) to reach an impressive 44,915 points. Meanwhile, the S&P 500 joined the celebration, rising 0.6% to hit 6,032 points. Even the tech-savvy Nasdaq Composite was buzzing, gaining 0.8% and inching ever closer to its all-time high from earlier this month.

The Trump Effect and Economic Resilience

So, what’s driving this surge? A significant factor is the recent victory of Donald Trump in the November 5 presidential election. Traders are riding high on a wave of optimism, buoyed by expectations of policy changes that could favor business growth. Additionally, robust economic data has lent support to the stock market, showcasing the resilience of the U.S. economy.

The Dow had its best month in over two years, while both the S&P 500 and Nasdaq saw increases of around 6%. This upswing can be likened to a thrilling rollercoaster ride—elevating our spirits as we ascend toward the peak, with the promise of exhilarating drops and turns ahead.

Looking Ahead: The Christmas Rally?

As we step into December, the festive spirit isn’t just in the air; it’s also palpable in the markets. There's chatter about whether gold will manage to pull off its eighth consecutive “Santa Rally” this month. Will the precious metal shine bright, or will it get overshadowed by the stock market's dazzling performance?

Meanwhile, Trump’s administration is already sending ripples through various sectors. Appointments and tariff discussions are creating waves, keeping traders on their toes. In fact, the prospect of tariffs on countries like Canada and Mexico has stirred significant price volatility in the markets. On day one of his administration, Trump has threatened a hefty 25% tariff on these nations, along with a potential 10% tariff on all imports from China. This news sent the Canadian and Mexican currencies tumbling, with the US dollar gaining strength and pushing USDCAD above 1.4150 to multi-year highs.

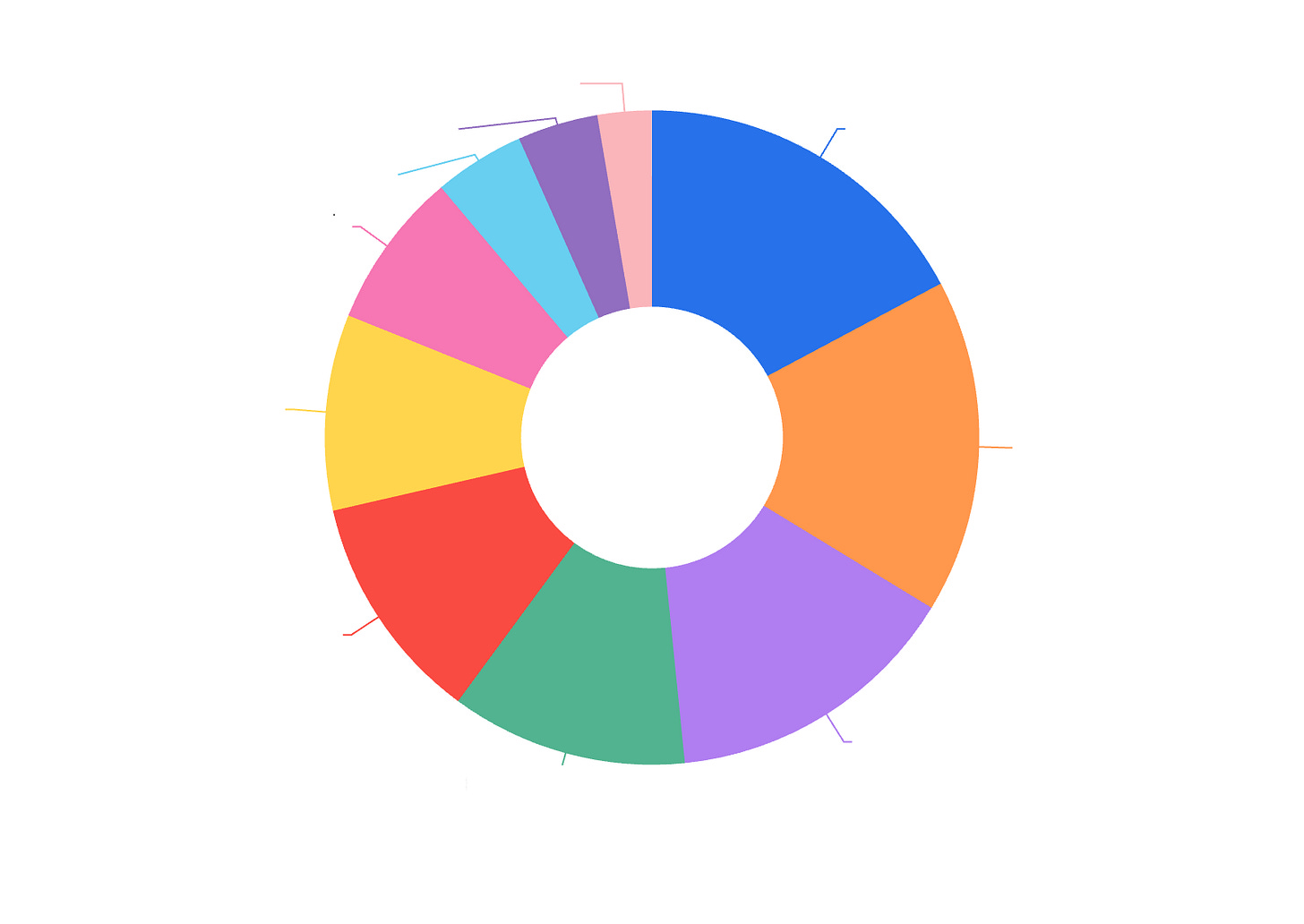

Our Portfolio's Performance

Amid this dynamic market landscape, our portfolio experienced impressive returns with a CAGR of 27.7% since inception. The portfolio metrics remain very healthy as below.

Check out our full portfolio below:

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.