Portfolio Performance - Dec 2024

In case you missed it:

The Santa Claus rally seems to have taken a detour this year, leaving investors a bit disappointed as we step into 2025. Despite the absence of this festive market boost, there's no need to feel like you're left with a lump of coal. The stock market may have had a rough ride recently, with the S&P 500 down 1.1%, the Dow Jones Industrial Average slipping 0.9%, and the Nasdaq Composite dropping 1.3% during a challenging holiday-shortened week. The S&P 500 is also poised to end the traditional Santa Rally period with a 1.1% decline, not exactly the ideal start to the New Year.

However, Wall Street remains hopeful. Investors are banking on a robust economy and strong corporate earnings, buoyed by potential tax cuts, deregulation, and fiscal stimulus from the Trump administration and a Republican-led Congress. The expectation is that these factors will counterbalance any inflationary pressures from potential tariffs and stricter immigration policies.

The Federal Reserve, of course, will have its say in this economic narrative. The central bank is anticipated to cut interest rates twice more in 2025, carefully navigating the fine line between maintaining a healthy job market and keeping inflation in check. So far, the Fed seems to be handling this balancing act well, with the labor market expected to add 160,000 jobs in December, a slight decrease from November's 227,000 but still a solid figure.

Investors will have to wait until later in January and early February to gauge the strength of these earnings.

As we navigate these uncertain waters, it's clear that while the Santa Claus rally may be missing in action, there's still plenty of optimism and potential for a prosperous year ahead.

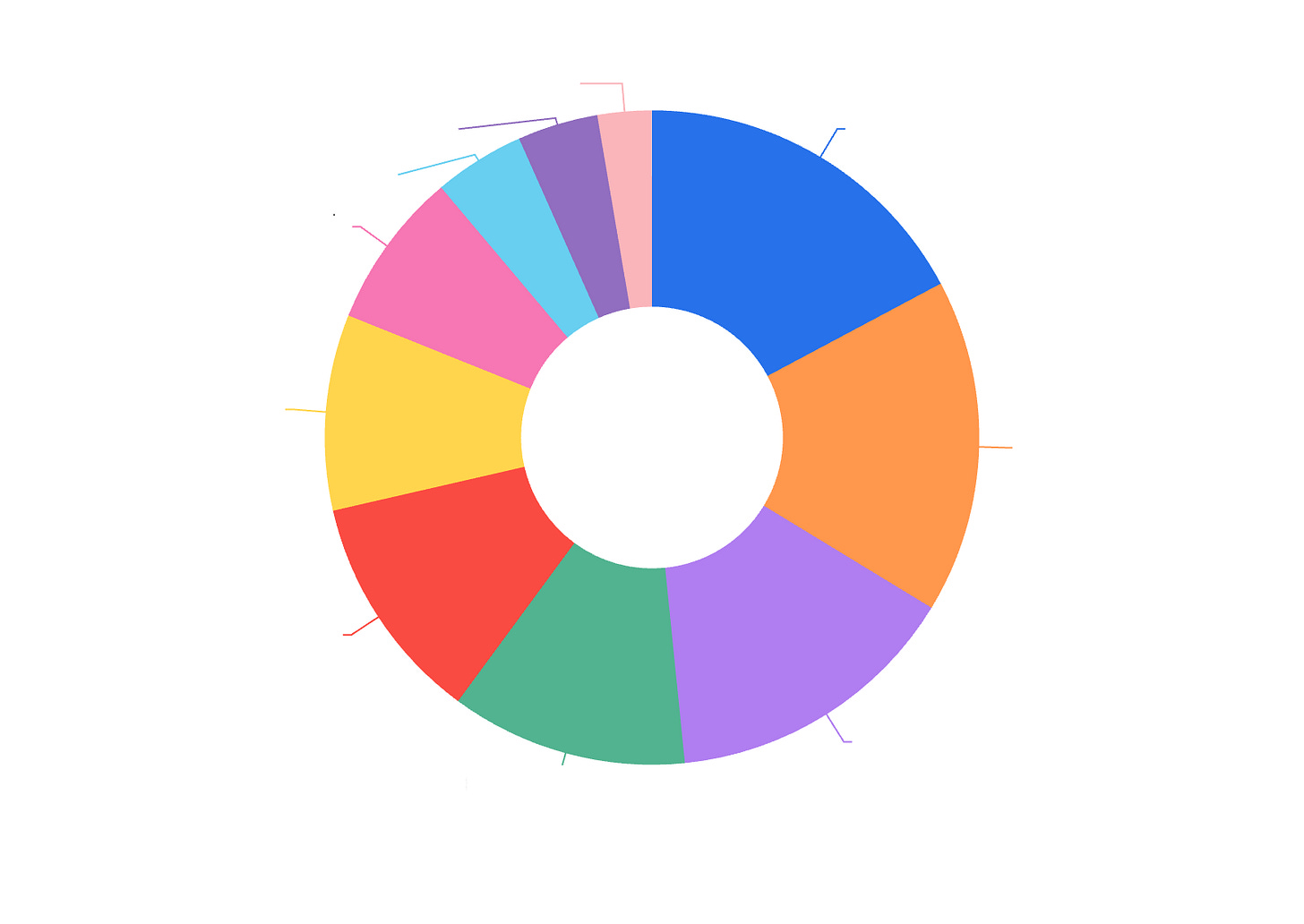

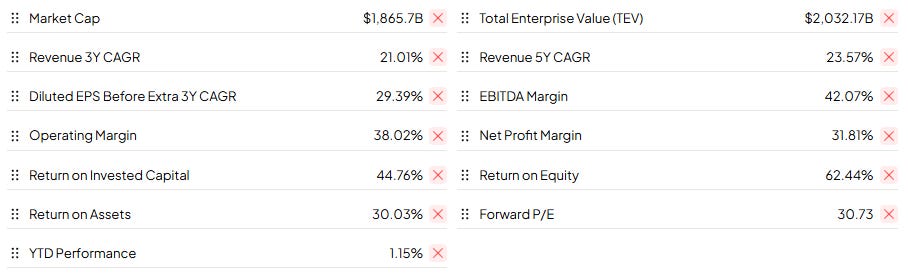

Our Portfolio's Performance

Amid this dynamic market landscape, our portfolio experienced impressive returns with a CAGR of 27.9% since inception. The portfolio metrics remain very healthy as below.

Check out our full portfolio below:

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.