Chapter 2 – The Magic Money Machine: Compound Interest & Dollar-Cost Averaging

Einstein allegedly called compound interest "the eighth wonder of the world." Whether he actually said that or not, the sentiment is absolutely true. Compound interest is the force that transforms modest monthly investments into million-dollar portfolios.

But here's what most investing guides won't tell you:

Compound interest only works if you can stay invested through market crashes, resist the urge to time the market, and maintain discipline when everyone else is panicking.

This chapter reveals the mathematical foundations of wealth building through ETFs, backed by real performance data and practical examples you can implement immediately. By the end, you'll understand exactly how much you need to invest, for how long, and what returns to expect on your journey to financial independence.

More importantly, you'll learn the psychological strategies that let compound interest work its magic without letting human emotions sabotage your success.

The $940,000 Mistake I Almost Made

Here's the calculation that changed my life. I was 25, making excuses about why I'd "start investing next year." Then my best friend showed me this brutal math:

Monthly investing of $500/month, with an annualised return of 8%:

The Cost of Waiting 10 Years:

Extra money invested: $60,000

Extra final wealth: $1,000,324

Pure compound interest advantage: $940,324

That extra million dollars comes from just $60,000 more in contributions. The other $940,000 is pure compound interest magic—money earned on money earned on money earned…

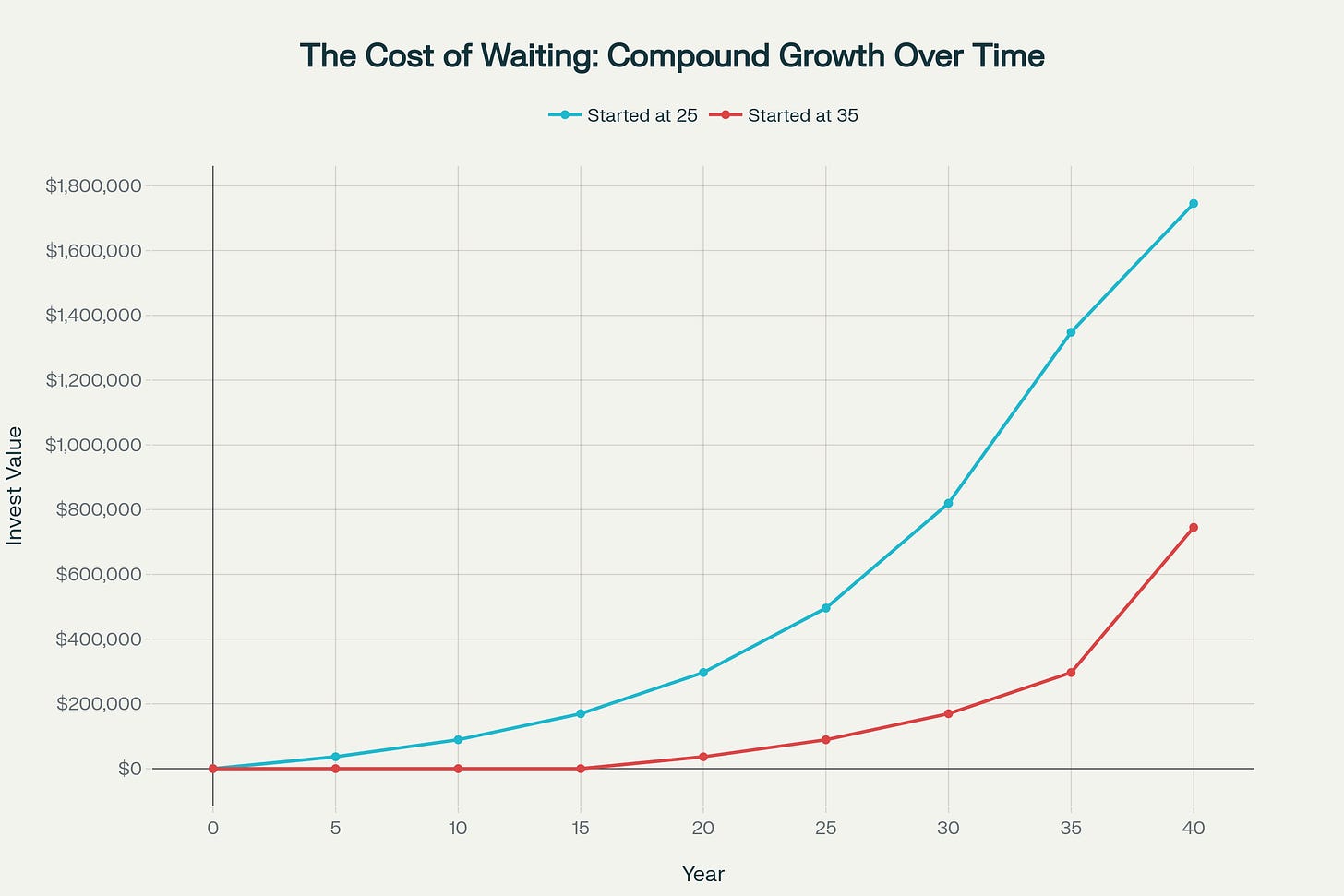

Why This Math Works

The key is that early contributions have the longest time to compound. That first $500 invested at age 25 has 40 years to grow. At 8% annual returns, it becomes $10,957 by retirement. The same $500 invested at age 35 only has 30 years to grow, becoming $5,031.

Every year you wait doesn't just cost you the current year's contribution—it costs you decades of compound growth on that contribution.

My Personal Wake-Up Call

When my friend showed me these numbers, I was making $35,000 per year but spending almost everything. I had less than $15,000 in savings sitting in a 0.5% savings account, earning $75 per year while inflation ate away 3% annually.

That night, I calculated that my "safe" savings account was actually guaranteed to lose purchasing power. Meanwhile, the stock market had averaged 10% annual returns over the past century, despite multiple crashes, recessions, and bear markets.

The choice became obvious: accept guaranteed losses in "safe" assets or accept short-term volatility for long-term gains.

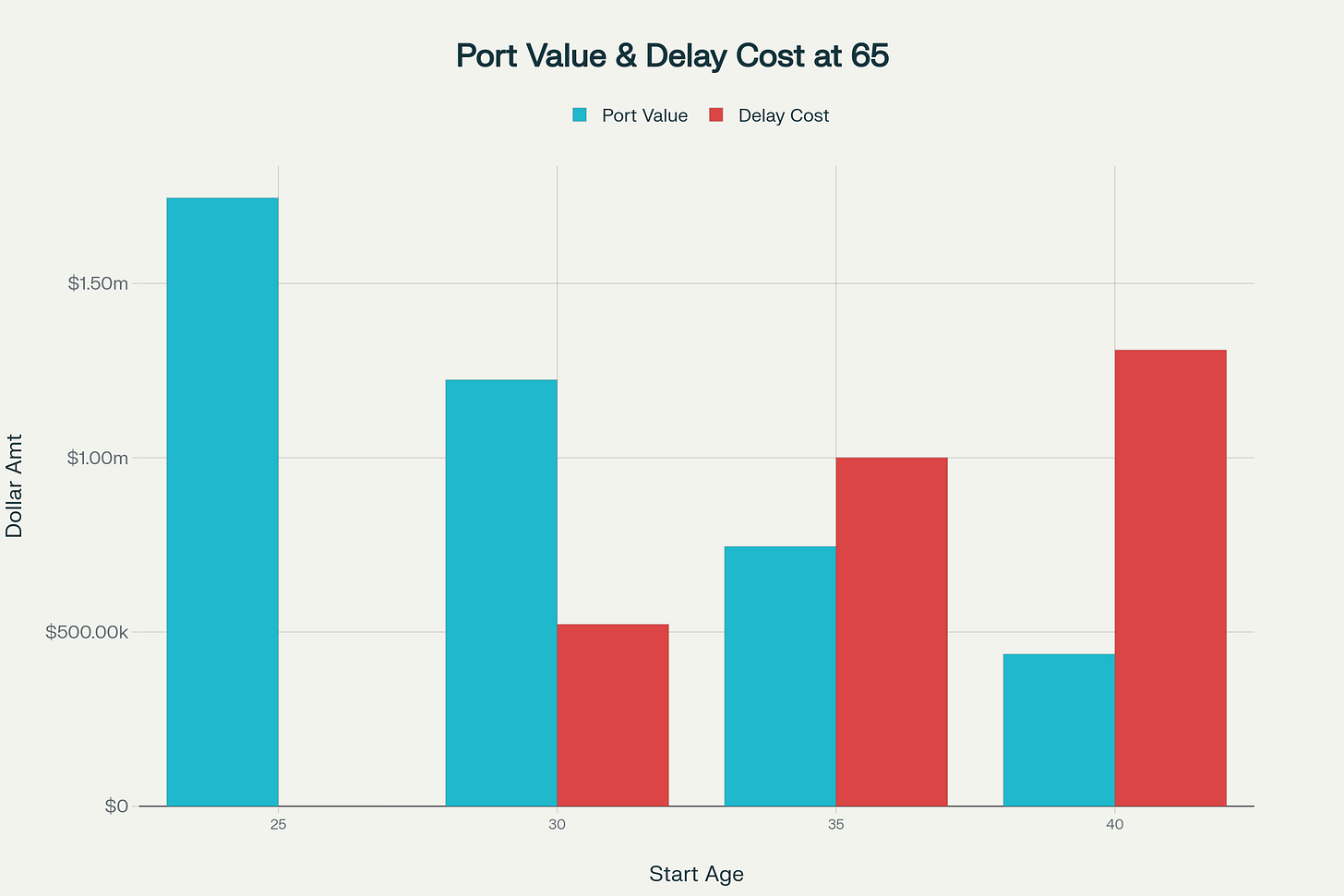

The Procrastination Tax

I call the cost of delaying investing the "procrastination tax". It's the most expensive tax you'll ever pay because it compounds against you for decades.

Consider these scenarios with $500/month investments at 8% annual returns:

The procrastination tax gets more expensive every year. There's no catch-up mechanism that can replicate the power of starting early.

The biggest obstacle to starting isn't lack of money—it's psychological. Here were my excuses and how I overcame them:

I don't have enough money to start.

Reality: Most brokerages have no minimum investment. You can start with $100.

I'll start when I have a better income.

Reality: It's easier to invest $500/month on a $50,000 salary than $2,000/month on a $100,000 salary due to lifestyle inflation.

I'll wait for the market to crash.

Reality: Time in the market beats timing the market. Even if you bought at the worst possible times, you'd still come out ahead over 20+ years.

I need to pay off debt first.

Reality: This depends on interest rates. If your debt is under 6%, you're often better off investing while making minimum payments.

The Power of Getting Started

The moment I stopped making excuses and started investing was the moment my financial life transformed. The hardest part about investing isn't the strategy—it's getting started.

That first $500 investment felt terrifying.

What if I picked the wrong fund?

What if the market crashed the next day?

What if I needed the money for an emergency?

Looking back, those fears were completely irrational. The "wrong" fund (VTI instead of SPY) would have made virtually no difference. Market crashes are buying opportunities, not disasters. And I had six months of expenses in cash—I didn't need to touch my investments.

The Emotional Journey

Starting to invest changed my relationship with money. Instead of seeing my paycheck as something to spend, I began seeing it as raw material for wealth building. Every dollar had potential energy that could compound for decades.

The first year was the hardest. Watching my $6,000 in contributions fluctuate with market movements felt like torture. But by year two, I was addicted to seeing the balance grow. By year five, the account balance exceeded my annual salary. By year ten, it was larger than any paycheck I'd ever received.

Why Most People Never Start

The sad truth is that most people know they should invest but never actually do it. They read articles about compound interest, nod along with the math, then go back to spending everything they earn.

The problem isn't intellectual—it's behavioral. Compound interest benefits are abstract and delayed, while spending provides immediate gratification. Our brains are wired to prioritize present pleasure over future security.

That's why the most successful investors automate their contributions. They remove the daily decision-making and treat investing like a utility bill—something that happens automatically whether they think about it or not.

The $940,000 Wake-Up Call

That conversation with my friend wasn't just about math—it was about identity. Did I want to be someone who made excuses or someone who took action? Did I want to be financially dependent or financially independent?

The $940,000 wasn't just money I'd miss—it represented freedom, options, and security. It was the difference between retiring comfortably at 65 or working into my 70s. It was the difference between financial stress and financial peace of mind.

Once I framed it that way, the decision became automatic. I would rather live slightly below my means for a decade than scramble to catch up for the rest of my life.

The compound interest curve is unforgiving to those who start late, but incredibly generous to those who start early. The question isn't whether you can afford to invest—it's whether you can afford not to.

Dollar-Cost Averaging: My Secret Weapon Against Myself

Here's my confession: I was terrible at market timing. In 2020, I was "waiting for a better entry point" while the market recovered 70% from the COVID lows. In 2022, I was convinced we'd see new lows while missing the October bottom. In 2024, I thought tech stocks were "obviously overvalued" before they rallied another 25%.

Dollar-cost averaging saved me from myself.

What Is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is deceptively simple: invest a fixed dollar amount at fixed intervals, regardless of market conditions. Instead of trying to time the market, you systematically invest the same amount every month, quarter, or paycheck.

When prices are high, your fixed investment buys fewer shares. When prices crash, you buy more shares on sale. Over time, you get a decent average price without the stress of trying to time tops and bottoms.

My DCA Evolution

I started with $300/month in 2018, bumped it to $500/month in 2020, and now invest $1,000/month as my income has grown. The beauty is that it's completely automated—my brokerage pulls the money on the 4th of every month whether I'm paying attention or not.

Here's what my DCA experience looked like during major market events:

2018 Market Correction (October-December):

Market dropped 20% in three months

My emotions: Terror, convinced this was "the big one"

My DCA system: Bought 15% more shares during the decline

Outcome: Those "crisis" purchases were up 40% within six months

2020 COVID Crash (February-March):

Market dropped 35% in 30 days

My emotions: Paralyzed, considered stopping contributions

My DCA system: Automatically bought VTI at $120, $100, and $90

Outcome: Those purchases were up 80% by year-end

2021 Everything Rally:

Market up 25%+ for the year

My emotions: FOMO, wanted to invest extra money

My DCA system: Kept buying at higher prices, maintaining discipline

Outcome: Avoided the temptation to chase performance

2022 Bear Market:

Market down 25% for the year

My emotions: Worried about recession, inflation, rate hikes

My DCA system: Accumulated shares throughout the decline

Outcome: Perfectly positioned for the 2023 recovery

The Behavioral Advantage

The mathematical case for DCA is mixed—lump-sum investing beats DCA about two-thirds of the time because markets rise more often than they fall. But behavioral evidence is overwhelming: DCA works because it gets executed.

Studies show that most investors never actually implement lump-sum strategies. They wait for "better opportunities," get paralyzed by analysis, or spend the money on something else. DCA removes these behavioral hurdles.

DCA vs. Lump Sum: A Personal Example

In January 2020, I received a $12,000 bonus. I had two choices:

Invest it all immediately (lump sum)

Spread it over 12 months ($1,000/month DCA)

The lump-sum strategy would have been mathematically superior—if I'd had the courage to execute it in March when markets crashed 35%. Instead, I would have probably panic-sold at the bottom.

The DCA approach meant I bought shares every month regardless of headlines. Some months I bought near the top, others near the bottom. The average worked out just fine, and I never lost sleep over timing decisions.

Real-World DCA Results

Let me share actual performance data from my DCA approach with VTI from 2018-2025:

Investment Pattern:

2018: $300/month ($3,600 total)

2019: $400/month ($4,800 total)

2020: $500/month ($6,000 total)

2021: $600/month ($7,200 total)

2022: $700/month ($8,400 total)

2023-2025: $750/month ($22,500 total)

Total invested: $52,500

Results as of August 2025:

Account value: $89,400

Total return: 70.3%

Annualized return: 9.7%

This includes investing through two bear markets (2018, 2022) and one crash (2020). The DCA approach captured most of the market's long-term uptrend while removing the emotional torture of trying to time entry and exit points.

The Psychology of Consistency

DCA works because it converts market volatility from an enemy into an ally. Here's the mental shift that changed everything for me:

Market crashes: "Sweet, I'm buying more shares cheap"

Market rallies: "Nice, my existing shares are worth more"

Market sideways: "Whatever, I'm accumulating"

This removed all emotion from my investing. No more refreshing my portfolio during lunch breaks. No more panic selling during headlines. No more FOMO buying during rallies.

Setting Up Your DCA System

Here's exactly how to implement dollar-cost averaging:

Choose your amount: Start with whatever you can afford consistently. Better to invest $200/month reliably than $500/month sporadically.

Pick your frequency: Monthly works for most people since it aligns with paychecks. Weekly or bi-weekly can work too.

Automate everything: Set up automatic transfers from your bank to your brokerage account, then automatic investments from cash into your chosen ETFs.

Ignore the noise: Don't check prices before your investment date. Don't try to "pause" during market uncertainty. Trust the system.

Increase gradually: As your income grows, increase your contribution amount. I bump mine up by $50-100 every January.

Common DCA Mistakes to Avoid

Mistake #1: Pausing During Crashes

This defeats the entire purpose. The best DCA returns come from buying during declines.

Mistake #2: Doubling Down During Rallies

Stick to your systematic approach. Extra money during bull markets often gets invested at peak prices.

Mistake #3: Checking Prices Too Often

The more you look, the more likely you are to make emotional decisions. Check your portfolio quarterly, not daily.

Mistake #4: Starting Too Small

$50/month won't build meaningful wealth. Push yourself to invest enough that it makes a difference.

DCA with Multiple ETFs

As your DCA amounts grow, you can split across multiple ETFs. Here's my current allocation:

VTI (Total Stock Market): 50% of contribution

SPY (S&P 500): 20% of contribution

QQQ (Tech Growth): 20% of contribution

VWO (Emerging Markets): 10% of contribution

My brokerage automatically splits my $750 monthly contribution: $375 to VTI, $150 to SPY, $150 to QQQ, and $75 to VWO. No thinking required.

The Long-Term Compound Effect

The real magic of DCA isn't the short-term risk reduction—it's the long-term compound effect of consistent investing. Every contribution benefits from decades of potential growth.

That $300 I invested monthly in 2018? It's now worth over $450 per month in today's dollars, and it will keep compounding for another 30+ years until I retire.

When DCA Doesn't Work

DCA isn't perfect for everyone:

If you have genuine market timing skills (extremely rare), you might beat DCA

If you're investing for short-term goals (under 5 years), the volatility reduction isn't worth the lower expected returns

But for most long-term investors building wealth through ETFs, DCA is the closest thing to a guaranteed success formula. It removes the hardest part of investing—human psychology—and replaces it with mechanical consistency.

DCA turned me from a stressed, reactive investor into a calm, systematic wealth builder. It's not the mathematically optimal strategy, but it's the psychologically optimal strategy.

In a world where most investors underperform their own mutual funds due to bad timing decisions, DCA ensures you'll capture your fair share of market returns with minimal emotional damage.

The market will always be volatile. Your contributions don't have to be.

Bonus Section: Price Appreciation and Dividends

When most people think about investment returns, they focus on price appreciation—watching their stock or ETF share price go up over time. But there's a second, often overlooked source of returns that has historically provided about 40% of the stock market's long-term gains: dividends.

Understanding both sources of growth transformed how I think about building wealth through ETFs.

The Price Appreciation Story

Price appreciation is straightforward: you buy VTI at $200 per share, and five years later it's worth $300 per share. Your $10,000 investment is now worth $15,000. This is what most people track obsessively, checking their portfolio balance daily to see how their shares have appreciated.

From 2015 to 2025, VTI's price appreciation alone delivered impressive returns:

- Starting price: $105.92

- Ending price: $313.03

- Price appreciation: 195.5%

But that's only part of the story.

The Dividend Reinvestment Magic

While VTI's price was appreciating, it was also paying quarterly dividends. These payments might seem small—typically 1.5-2% annually—but when reinvested, they compound into a significant portion of total returns.

Here's what happened to my first VTI purchase in 2015:

Initial Purchase: 100 shares at $105.92 = $10,592

Quarterly Dividend in 2015: $0.55 per share

Annual Dividend Income: $220 (100 shares × $0.55 × 4 quarters)

That $220 didn't sit in cash—it automatically purchased 2.08 additional shares (at the then-current price). Those additional shares then generated their own dividends the next quarter.

Fast Forward to 2025:

Thanks to dividend reinvestment plus additional purchases, my original 100-share position has grown to approximately 340 shares. Each share now pays about $1.73 annually in dividends, so my quarterly dividend payment is roughly $147.

That $147 quarterly payment buys nearly 2 additional shares, which will generate their own dividends next quarter. This is compound growth in action.

The Historical Evidence

From 1930 to 2023, the S&P 500 delivered:

- Price appreciation alone: 7.7% annualized

- Total return (including dividends): 10.5% annualized

That 2.8 percentage point difference might not sound like much, but compounded over decades, it's enormous. A $10,000 investment growing at 7.7% becomes $166,000 after 30 years. The same investment growing at 10.5% becomes $423,000—more than double.

Why Dividends Matter More Than You Think

Dividends provide several benefits beyond just the extra returns:

1. Forced Rebalancing

When dividends are reinvested, they automatically buy more shares when prices are low and fewer shares when prices are high. This is natural dollar-cost averaging.

2. Behavioral Anchor

Even during bear markets, dividend payments continue. This provides psychological comfort that the underlying businesses are still generating cash flow.

3. Compound Acceleration

Reinvested dividends don't just add to your returns—they accelerate them. More shares mean more future dividends, which buy even more shares.

The Power of Automatic Reinvestment

Every major brokerage offers automatic dividend reinvestment (DRIP) at no cost. When you enable DRIP, dividend payments automatically purchase additional shares or fractional shares of the same ETF.

This automation is crucial because:

- You never have to decide what to do with dividend payments

- There's no cash sitting idle between dividend payments and reinvestment

- Fractional shares mean 100% of dividends get invested immediately

- The compounding happens seamlessly in the background

Dividend Aristocrats vs. Growth ETFs

Some investors prefer dividend-focused ETFs that own companies with long histories of increasing dividends. While these can be good investments, I prefer broad-market ETFs like VTI for several reasons:

Diversification: VTI owns both dividend-paying and growth companies, automatically balancing income and appreciation potential.

Flexibility: Companies can allocate capital where it's most productive—sometimes that's dividends, sometimes it's reinvestment in growth.

Lower Fees: Broad-market ETFs typically have lower expense ratios than specialized dividend ETFs.

Common Dividend Mistakes

Mistake #1: Chasing High Yields

A 6% dividend yield might seem better than 2%, but often high yields signal troubled companies whose stock prices have fallen. Focus on sustainable dividend growth, not just current yield.

Mistake #2: Taking Dividends as Cash

Unless you're in retirement and need income, always reinvest dividends. The compound effect is too powerful to give up.

Mistake #3: Dividend Timing

Some investors try to buy just before dividend dates and sell after. This doesn't work—stock prices typically fall by the dividend amount on the ex-dividend date.

Mistake #4: Ignoring Total Return

A stock that appreciates 8% with no dividend beats a stock that appreciates 4% with a 3% dividend. Focus on total return, not just dividend yield.

The Takeaway on Dividends

Dividends aren't just "bonus" payments—they're a core component of long-term wealth building. When automatically reinvested, they create a self-reinforcing cycle: more shares generate more dividends, which buy more shares, which generate even more dividends.

The best part? This happens completely in the background once you enable automatic reinvestment. You don't have to think about it, time it, or manage it. The dividends just quietly compound year after year, adding substantial value to your long-term returns.

This is why I always enable dividend reinvestment on all my ETF holdings. It's free money that buys more money-making assets. In the next section, we'll explore how this dividend compounding combines with price appreciation to create the exponential growth curves that build real wealth.

Key Takeaways: Your Compound Interest Action Plan

After exploring the mathematics, psychology, and real-world applications of compound interest and dollar-cost averaging, here are the essential principles to implement immediately:

The Mathematics of Wealth Building

Time is your most powerful investing tool. Starting at 25 vs 35 can mean $940,000 more wealth at retirement with identical monthly contributions. Every year you delay compounds against you for decades.

Compound interest is exponential, not linear. Most of your wealth accumulation happens in the final years of investing. Early contributions set the foundation for exponential growth later.

Dividends represent 40% of long-term stock returns. Always enable automatic dividend reinvestment to capture this compound accelerator.

The Psychology of Systematic Investing

Dollar-cost averaging removes the behavioral barriers that destroy most investors. You'll never perfectly time the market, but you can systematically participate in its long-term growth.

Automation beats willpower every time. Set up automatic transfers and investments to remove daily emotional decision-making.

Market crashes become opportunities when you're dollar-cost averaging. Your fixed contributions buy more shares when prices fall, accelerating long-term returns.

Simplicity outperforms complexity. Stick to 3-5 broad-market ETFs rather than trying to optimize across dozens of specialized funds.

Coming up next

Chapter 3 will show you exactly how to implement these principles using specific ETFs. We'll build a core portfolio designed to capture broad market returns with minimal complexity, then explore how to add growth tilts and diversification as your wealth grows.

But the most important step happens before you turn the page: making the commitment to start. Compound interest can't help you until you begin feeding it with consistent contributions.

Wealth building through ETFs isn't about picking the perfect funds or timing the market perfectly. It's about harnessing the mathematical certainty of compound interest through disciplined, systematic investing.

The formula is simple:

- Invest consistently through all market conditions

- Reinvest all dividends automatically

- Keep costs low with broad-market ETFs

- Let time and compound interest work their magic

Execute this formula for 20-30 years, and you'll join the millions of ordinary investors who've built extraordinary wealth through the power of compound interest and the discipline of dollar-cost averaging.

The magic money machine is ready to work for you. All it needs is your consistent contributions and the gift of time.

Sign up now and get our free REITs’ Numerical Ratings.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any form. Please do your own research and seek advice from a qualified financial advisor. From time to time, I have positions in all or some of the mentioned stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.