Capitaland Ascendas REIT (SGX: A17U)'s Growth Slowed Down By Higher Cost

Capitaland Ascendas REIT (SGX: A17U), the second largest listed S-REIT and a prominent player in the industrial sub-sector, recently released its financial results, reporting a decline in distribution per unit (DPU) but showcasing positive signs of growth. Amidst rising operating and funding costs, this article will delve into CLAR's financial performance, portfolio metrics, growth prospects, and the potential factors that could impact its trajectory.

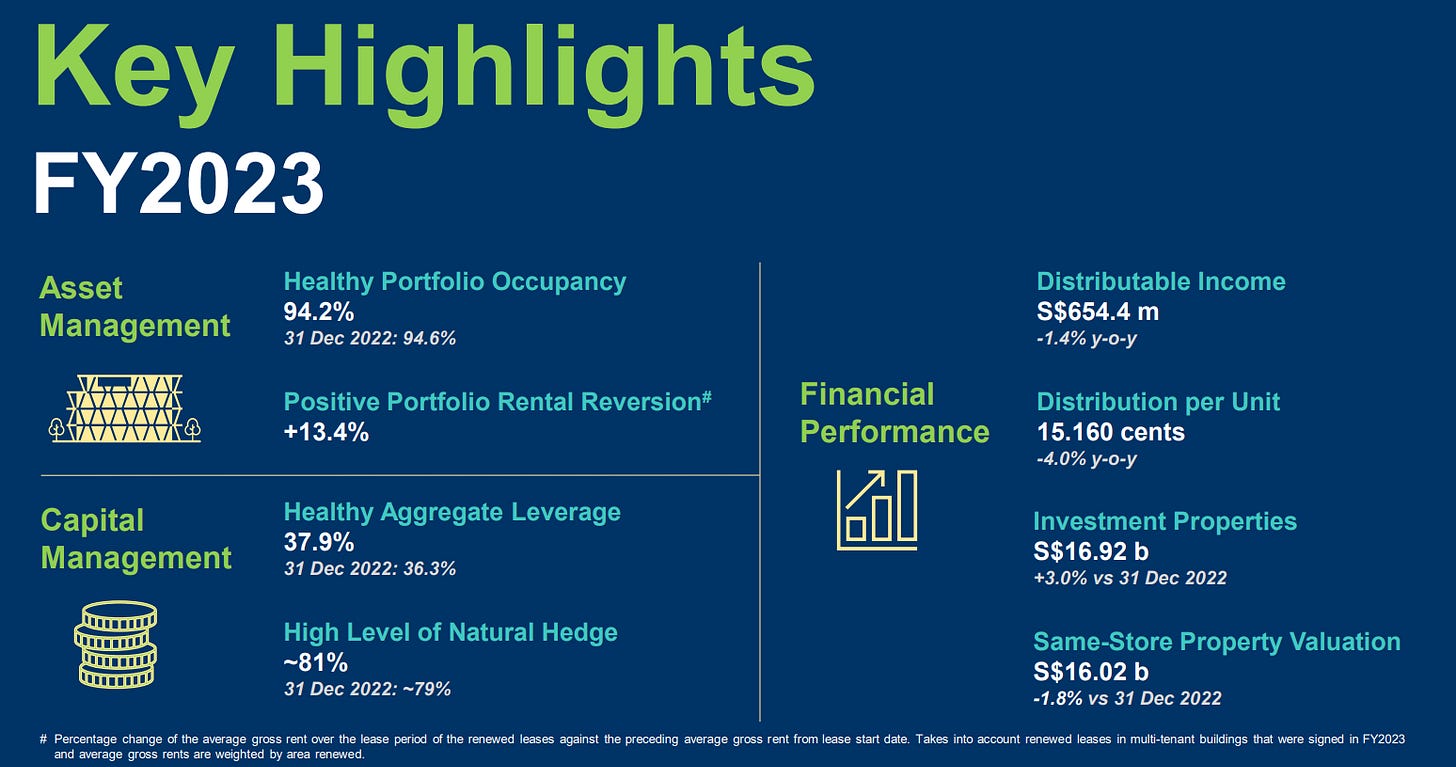

Financial Performance

In the second half of the year, Capitaland Ascendas REIT reported a solid 11% year-on-year increase in revenue, reaching SGD761.7 million, and a 4.6% increase in Net Property Income (NPI), reaching SGD514.3 million. The full-year figures stood at SGD1,479.8 million for revenue and SGD1,023.2 million for NPI, representing a growth of 9.4% and 5.6%, respectively.

The REIT's acquisitions played a significant role in driving this revenue growth. However, higher utility costs, property taxes, and borrowing costs put pressure on margins, resulting in a 250 basis points decrease for the full year. The funding cost also saw a substantial increase of 26% and 37% for the second half and the full year, respectively, reaching 3.5%.

Portfolio Metrics:

While Capitaland Ascendas REIT experienced a slight decline in occupancy, dropping 40 basis points year-on-year to 94.2%, it achieved strong positive rental reversion. The company reported a 15% reversion rate for the fourth quarter and 13.4% for the full year. This is driven by logistics in Singapore and under-rented business parks in the US and Australia.

The REIT will remain proactive in pursuing acquisitions in Singapore, the UK, and Europe, and has ambitious redevelopments in the pipeline, including the conversion of a UK data center. With a focus on maintaining gearing below 40%, Capitaland Ascendas REIT aims to optimize its portfolio for sustained growth.

Growth vs Risks

Strong balance sheet

Capitaland Ascendas REIT boasts an impressive SGD124 billion in assets under management. As the largest listed S-REIT in the industrial sub-sector, it maintains a diverse portfolio comprising business space, life sciences, logistics, and data centers, which together account for 81% of its SGD16.4 billion portfolio.

The REIT's strategic acquisitions in Australia, the UK, and the US contribute to earnings visibility, while its Singapore properties solidify its footprint in the business space sector. The company's proactive approach to portfolio reconstitution has strengthened its balance sheet, and it aims to allocate capital to higher-yielding and newer assets.

Potential risks

While the REIT’s DPUs are expected to remain resilient, driven by the favorable exposure to logistics, business parks, and hi-specs industrial assets, as well as the contributions from recent overseas acquisitions, there are potential downsides include risks associated with rapid overseas expansion, particularly in US business parks and European data centers.

Older Singapore business parks may require capital expenditure and face temporary downtime during redevelopment. Its financial report also shows that the REIT is facing some headwinds from higher funding and operating costs. On the upside, an earlier-than-expected pickup in leasing demand, favorable rental reversion trends, and accretive acquisitions could propel growth.

Summary

Capitaland Ascendas REIT’s financial performance reflects a mixed picture of strengths and challenges. While the company has achieved positive reversions and revenue growth, it grapples with rising borrowing costs and higher operating expenses. The portfolio metrics demonstrate a decline in occupancy but strong reversion rates.

Its value proposition lies in its position as the second largest S-REIT, strong sponsorship, and a portfolio that strategically aligns with new economy assets. The company's growth prospects hinge on various factors, including leasing demand, rental reversion trends, and successful execution of acquisitions. Investors who are looking for stable DPU and long term investing can consider adding the REIT to the portfolio.