A Simple Momentum Strategy That Reduce Risk by 63%

The ETFs Millionaire book is live!

For paid members, you can get full access break down by chapters here. Alternatively, you can get also get the book through Amazon below:

ETFs Millionaire: How I Built a Seven-Figure Portfolio with ETFs

Market crashes are brutal. That 2020 flash crash? The 2008 meltdown? The crypto implosion of 2022? They wipe out years of gains in weeks. Most investors just grit their teeth and hold. But what if there was a smarter way?

Meet momentum—a strategy so refreshingly simple it almost sounds too good to be true. The idea is straightforward: hold winners when they’re hot, and exit when they lose momentum. No complex algorithms. No black-box models. Just price trends and a monthly rebalance.

Before going into the strategy, let’s look at the backtest results first.

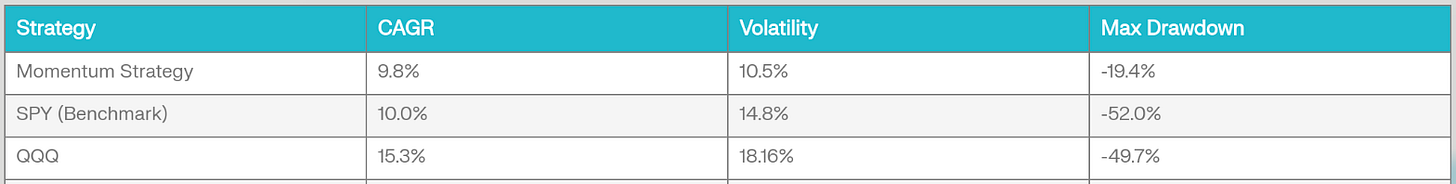

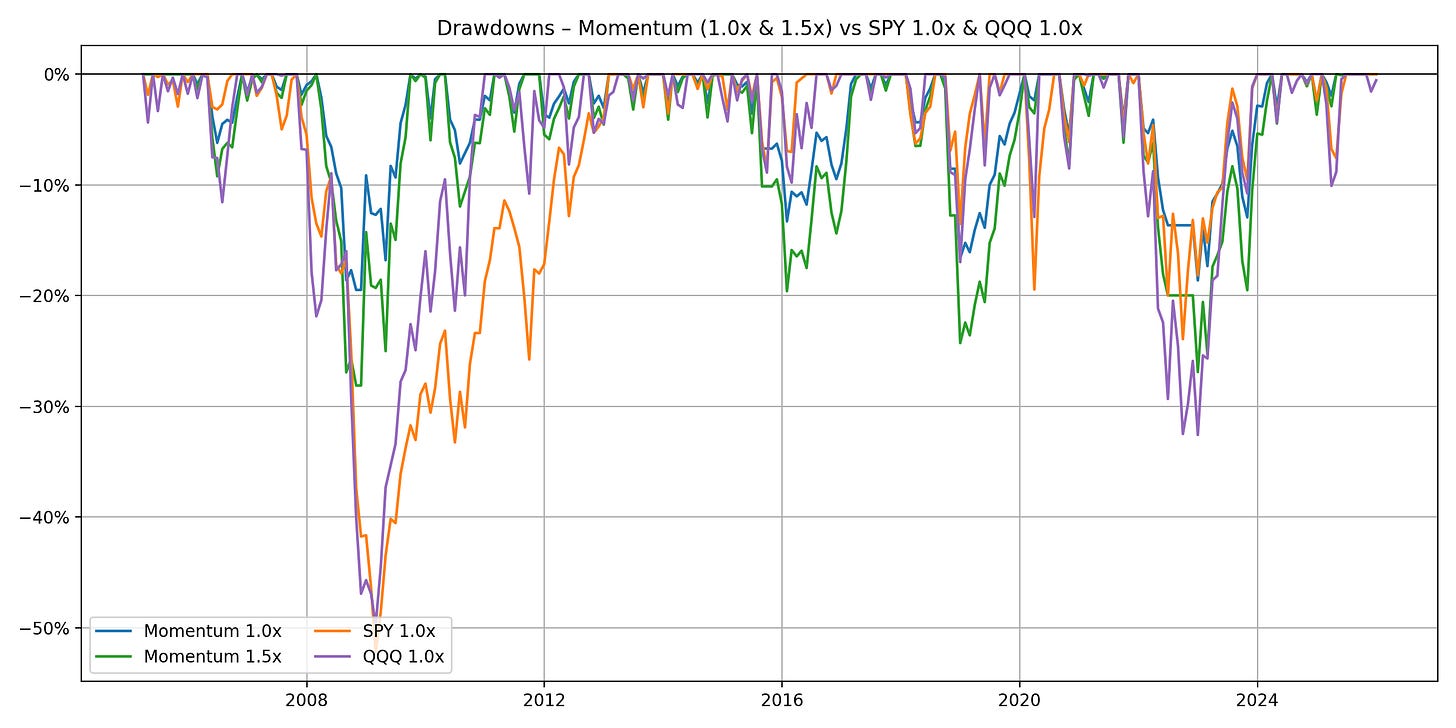

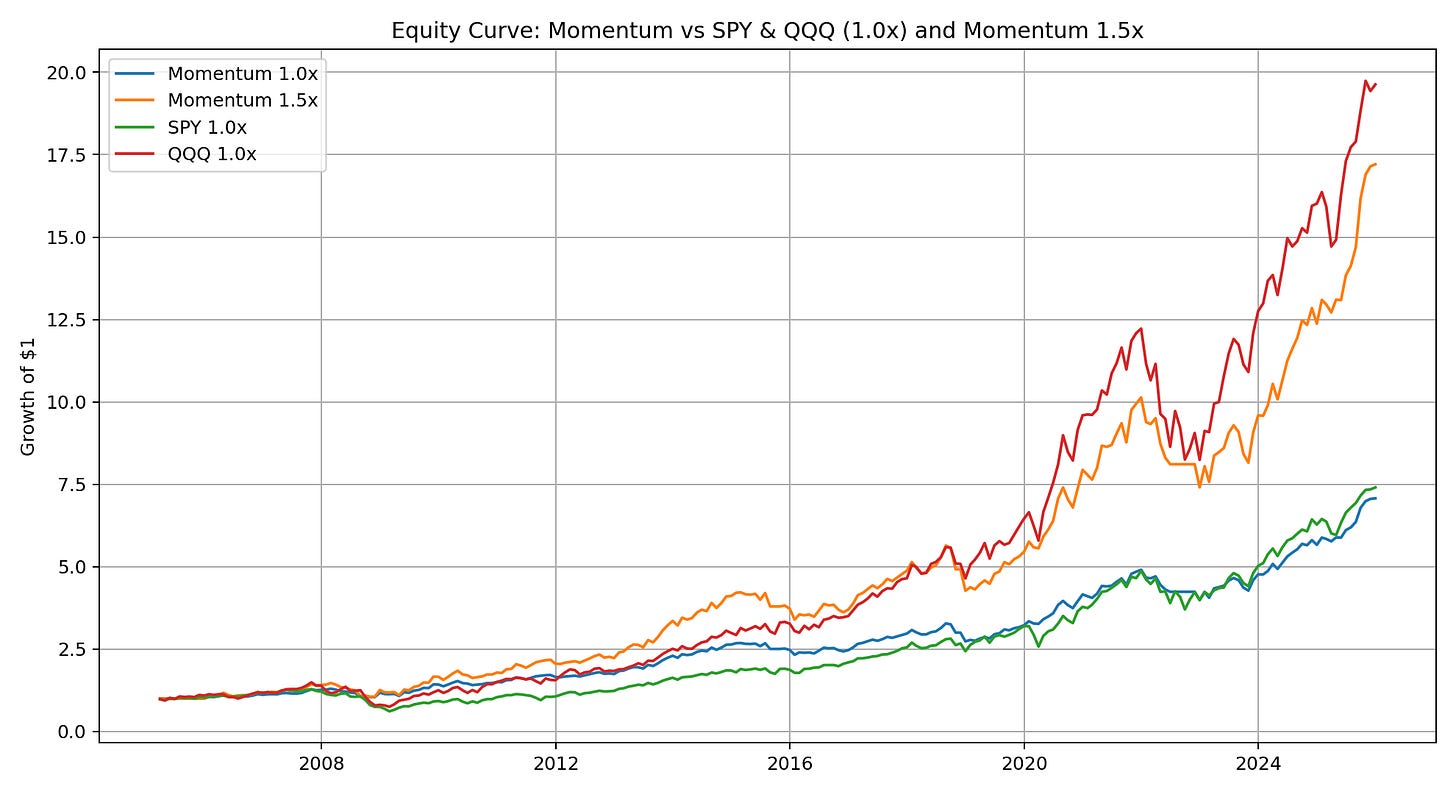

We tested this approach on a four-asset portfolio of SPY, QQQ, GLD, and TLT—the bread and butter of diversified investing—over the past 20 years. The results? A 63% reduction in maximum drawdowns compared to the S&P 500 alone, while delivering nearly identical long-term returns.

Yes, momentum strategy’s 9.8% CAGR trails QQQ’s 15.3% by 5.5 percentage points. But compare the journeys. With momentum, you’re sleeping soundly through market chaos with a -19.4% drawdown. With QQQ, you’re white-knuckling through -49.7% crashes that could force you to sell at the worst time—locking in losses just before the rebound.

Over 20 years, that disciplined, risk-managed approach often outperforms the higher-volatility pure play when you factor in behavioral costs and the ability to stay the course.

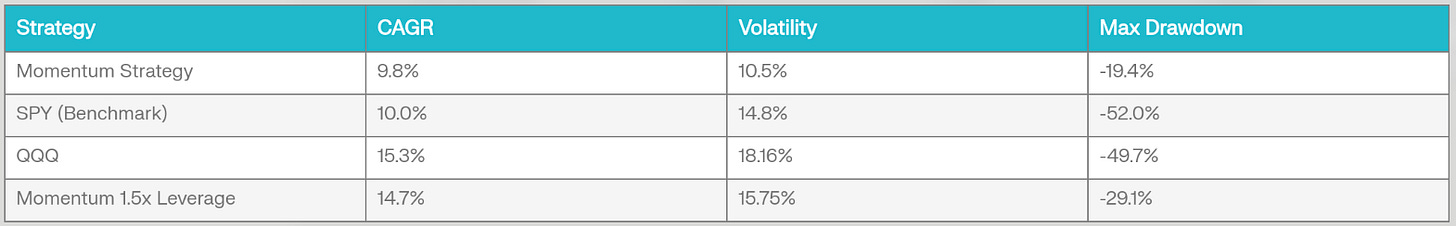

But here’s where it gets spicy: if you have the risk tolerance and margin capacity, layering 1.5x leverage onto momentum flips the script entirely. Suddenly you’re earning 14.7% CAGR—nearly matching QQQ’s upside—while your maximum drawdown stays at -29.1%, still better than QQQ’s worst day.

You’re essentially getting the aggressive returns without the aggressive downside. That’s not luck. That’s leverage amplifying a smarter strategy. For investors willing to accept moderate volatility and have the discipline to maintain margin positions through downturns, this is where momentum with leverage becomes genuinely compelling.

Overall results:

Now, let’s go into the details - the setup (it’s refreshingly boring)

Keep reading with a 7-day free trial

Subscribe to Wealth Insights to keep reading this post and get 7 days of free access to the full post archives.